30% Bitcoin Drop Sparks Terror as Sentiment Indexes Hit ‘Extreme

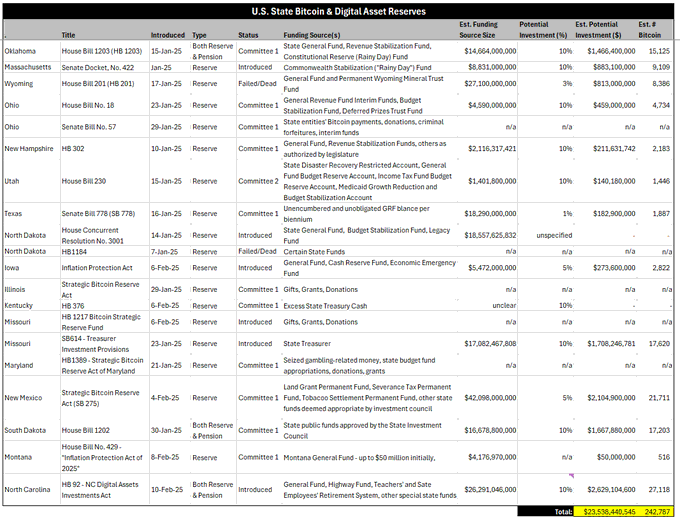

$23B Bitcoin boom? VanEck says state reserve bills could spark massive inflows

(Originally posted on : Invezz )

Several US states, including Texas, Pennsylvania, and Ohio, are pushing proposals to invest public funds in cryptocurrencies or establish state-level bitcoin reserves.

Asset manager VanEck analysed 20 such bills and estimated that, if implemented, they could lead to $23 billion in bitcoin purchases, equivalent to approximately 242,700 BTC.

We analyzed 20 state-level Bitcoin reserve bills.

If enacted, they could drive $23 billion in buying, or 247k BTC.

This sum is independent of any pension fund allocations, likely to rise if legislators move forward.

This estimate excludes potential contributions from pension funds and is expected to rise as legislative efforts progress.

Florida recently proposed a bill to allow state investments in bitcoin and other cryptocurrencies, while North Carolina introduced legislation enabling the State Treasurer to invest in “qualifying digital assets.”

Meanwhile, Arizona’s Senate Finance Committee approved a similar bill, which now moves to the Senate Rules Committee for further consideration.

States like Colorado, Utah, and Louisiana already accept cryptocurrencies for state payments, and Detroit announced plans last year to become the largest US city to accept crypto.

Trump’s pro-crypto government

At the federal level, President Donald Trump has directed efforts to establish a regulatory framework for digital assets, including stablecoins, and to evaluate a potential national digital assets reserve.

White House Crypto Czar David Sacks recently praised Bitcoin as an “excellent store of value.”

The BITCOIN Act of 2024, introduced by Senator Cynthia Lummis, proposes the US Treasury acquire 1 million BTC over five years to create a national bitcoin reserve.

VanEck modeled the impact of such a reserve, suggesting it could offset $42 trillion of US national debt by 2049, provided Bitcoin grows 25% annually to reach $42.3 million per BTC.

However, this optimistic scenario requires a 43,000% price increase over 24 years and assumes US debt compounds at 5% annually from a base of $37 trillion in 2025.

Between Q4 2022 and Q4 2024, governments worldwide added 377,000 BTC to their reserves, mainly through criminal seizures, according to VanEck.

State-level bitcoin reserves and a potential federal stockpile could significantly impact the adoption of digital assets and influence global cryptocurrency markets.

As state and federal initiatives to incorporate Bitcoin into fiscal strategies gather momentum, these developments highlight the growing recognition of digital assets in economic planning and their potential role in addressing national debt and driving financial innovation.

The states of Bitcoin

Earlier this week, Maryland and Kentucky joined a growing number of US states considering Bitcoin and digital assets as part of their financial strategies to bolster reserves.

In Maryland, Democratic State Delegate Caylin Young introduced the “Strategic Bitcoin Reserve Act of Maryland” this week.

The proposed legislation would allow the state to establish a Bitcoin reserve, explicitly naming the cryptocurrency in the bill.

It also grants the Maryland State Treasurer the authority to invest in Bitcoin using funds derived from the enforcement of gambling violations.

Meanwhile, Kentucky’s House Bill 376, introduced by Republican State Representative TJ Roberts, also aims to authorize state investments in digital assets and precious metals.

Although the bill does not mention Bitcoin by name, it limits eligible digital assets to those with a market capitalization of at least $750 billion, effectively designating Bitcoin as the primary option.

Maryland and Kentucky join 16 other states that have proposed similar legislation, while North Dakota remains the only state to have outright rejected such a measure, according to the Bitcoin Reserve Monitor.

The post $23B Bitcoin boom? VanEck says state reserve bills could spark massive inflows appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Zcash

Zcash  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Stellar

Stellar  WETH

WETH  Wrapped eETH

Wrapped eETH  Monero

Monero  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Hedera

Hedera  Sui

Sui  Shiba Inu

Shiba Inu  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  World Liberty Financial

World Liberty Financial  USDT0

USDT0  sUSDS

sUSDS  Uniswap

Uniswap  Toncoin

Toncoin  Polkadot

Polkadot  Cronos

Cronos  PayPal USD

PayPal USD  MemeCore

MemeCore  Mantle

Mantle  USD1

USD1  Canton

Canton  Bittensor

Bittensor  Currency One USD

Currency One USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Falcon USD

Falcon USD  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  Pi Network

Pi Network  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  Pepe

Pepe  Aptos

Aptos  Binance-Peg WETH

Binance-Peg WETH  Wrapped SOL

Wrapped SOL  HTX DAO

HTX DAO  Pump.fun

Pump.fun  KuCoin

KuCoin  Ondo

Ondo  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  PAX Gold

PAX Gold  USDtb

USDtb  BFUSD

BFUSD  syrupUSDC

syrupUSDC  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Official Trump

Official Trump  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Circle USYC

Circle USYC  Global Dollar

Global Dollar  Ripple USD

Ripple USD  Filecoin

Filecoin  Gate

Gate  Wrapped BNB

Wrapped BNB  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Quant

Quant  VeChain

VeChain  Function FBTC

Function FBTC  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Lombard Staked BTC

Lombard Staked BTC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)