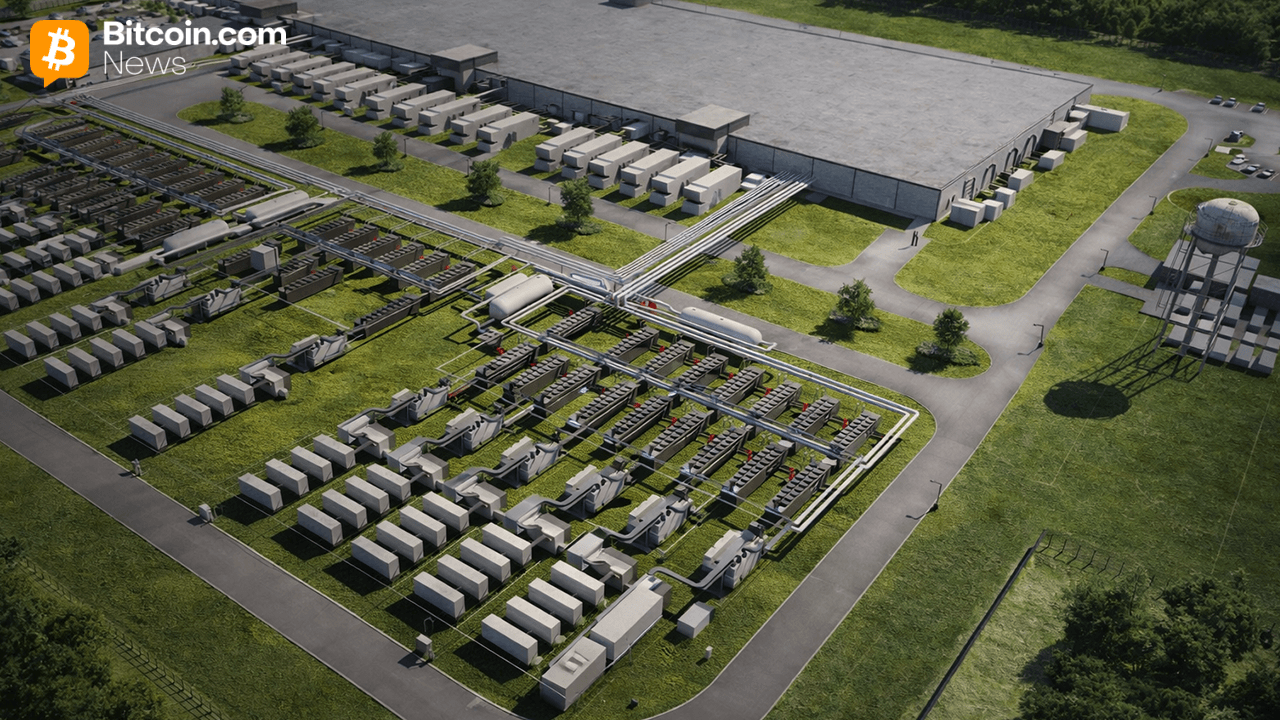

Morgan Stanley Backs Core Scientific With up to $1B Financing

Central Bank of the United Arab Emirates (CBUAE) enforces new regulations requiring licensed financial institutions (LFIs) to verify customer identities

(Originally posted on : Crypto News – iGaming.org )

The Central Bank of the United Arab Emirates (CBUAE) has proposed stronger regulations for licensed financial institutions (LFIs) and their interaction with virtual assets and virtual asset service providers (VASPs) in an effort to improve financial security and combat criminal activity. These rules aim to strengthen anti-money laundering and counter-terror financing initiatives in the financial environment of the UAE and are in line with international standards established by the Financial Action Task Force.

New players only. Welcome Bonus – 350% bonus on your first deposit up to 5BTC

Verifying Customer Identities

A New Condition The new regulations will require LFIs in the UAE to confirm the identity of each and every one of its clients. This policy aims to increase accountability and transparency in the financial sector. By the end of June, the CBUAE anticipates that these regulations will have been put into effect.

Compliance Guidelines for LFIs

The CBUAE has published extensive recommendations covering the hazards related to virtual assets and VASPs in a 44-page document. The specific policies and guidelines that LFIs must follow when dealing with crypto-related activity are laid out in this document. LFIs can match their procedures with global standards by adhering to these rules.

New players only. Welcome Bonus – 125% bonus on your first deposit up to $2,500

Definition of LFIs and Collaboration with VASPs

LFIs are a broad category of non-crypto financial organizations that collaborate with VASPs, according to the CBUAE definition. This includes financial institutions like banks and finance firms as well as payment service providers like payment processors and registered hawala providers. LFIs must request non-objection approval from the central bank individually in order to work with VASPs. The use of unauthorized VASPs in collaboration is strictly forbidden.

Enhanced Customer Verification and Monitoring

LFIs must fully comprehend the nature of a customer’s business in addition to the basic customer verification process. To do this, a profile that includes the kinds and quantities of transactions the consumer is anticipated to conduct must be created. Additionally, LFIs must keep an eye on the volume of crypto transactions made by non-institutional, individual clients with VASPs, especially those coming from high-risk regions. Customers are only able to transfer virtual assets outside of the UAE-licensed VASP ecosystem in such circumstances.

New players only. Welcome Bonus – 100% bonus on your first deposit up to 5 BTC

International Collaborations and Fintech Development

The CBUAE has proven that it is dedicated to promoting global collaboration in the regulation of digital assets. Recently, representatives from the CBUAE and the Hong Kong Monetary Authority met to discuss how they may work together to regulate digital assets. The central banks also pledged to facilitate conversations on cooperative fintech development projects and knowledge exchange.

In order to prevent illegal activity and protect the integrity of the financial system, the Central Bank of the UAE has introduced harsher requirements for licensed financial institutions. The CBUAE seeks to boost anti-money laundering and counter-terror funding initiatives in the UAE by enforcing client identification verification procedures and supplying thorough instructions. The UAE’s commitment to supporting fintech innovation and creating a safe and open financial ecosystem is further evidenced by the cooperation with international counterparts.

New players only. Welcome Bonus – 350% bonus on your first deposit up to 5BTC

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Figure Heloc

Figure Heloc  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Monero

Monero  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Hedera

Hedera  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Zcash

Zcash  Sui

Sui  WETH

WETH  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Circle USYC

Circle USYC  Pi Network

Pi Network  Sky

Sky  Aster

Aster  Bittensor

Bittensor  Aave

Aave  Falcon USD

Falcon USD  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  NEAR Protocol

NEAR Protocol  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Ethena

Ethena  Ondo US Dollar Yield

Ondo US Dollar Yield  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Filecoin

Filecoin  Wrapped BNB

Wrapped BNB  Official Trump

Official Trump  Function FBTC

Function FBTC