Billionaire Novogratz Sees BlackRock’s Bitcoin ETF as Crypto Game-changer

(Originally posted on : Crypto News – iGaming.org )

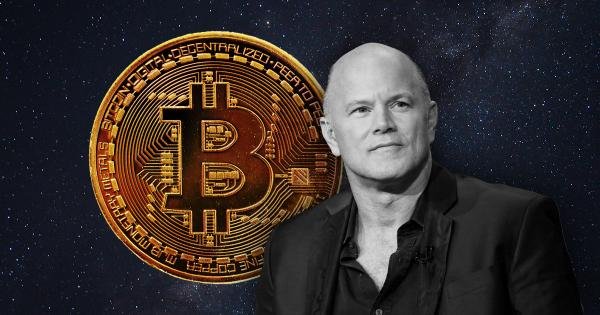

Mike Novogratz, billionaire and CEO of Galaxy Digital, believes the approval of a Bitcoin exchange-traded fund (ETF) by BlackRock, the world’s largest asset manager, could be a potential game-changer for the world’s flagship cryptocurrency.

In a recent appearance on The Claman Countdown on FOX, Novogratz revealed his anticipation for BlackRock’s Bitcoin ETF success. With more than $10 trillion in assets under management, BlackRock’s endorsement could potentially encourage more blue-chip investors to invest in cryptocurrencies.

New players only. Exclusive 177% Welcome Bonus + 77 Free Spins in Aztec Magic Deluxe

Yet, the US Securities and Exchange Commission (SEC) has so far not approved any Bitcoin ETF applications, a reality Novogratz acknowledges with a sense of hopeful optimism. “I say a Hail Mary and two Our Fathers every night that they are successful. If [BlackRock chief executive] Larry Fink can pull it off, that’s a stunningly big deal for the space because it makes it really easy for institutions to participate [as] they’re the biggest asset manager in the world…,” he said.

The Need for a Bitcoin ETF

Novogratz insists on the logical need for a Bitcoin ETF, especially given that a futures ETF already exists. This point was underscored when a judge questioned the SEC’s rationale for denying Grayscale’s ETF in a recent case.

Novogratz reiterated his view to his 463,000 Twitter followers that a successful BlackRock Bitcoin ETF would be a boon for the leading crypto asset. He stated, “BlackRock getting a BTC ETF through would be the best thing that could happen to BTC.”

New players only. Welcome Bonus – 125% bonus on your first deposit up to $2,500

BlackRock is not the only company aiming to establish a Bitcoin ETF. The firm filed an application with the SEC for the iShares Bitcoin Trust on June 15. Other entities that have pursued the creation of Bitcoin ETFs include Grayscale, VanEck, and Cathie Wood’s ARK Invest, all of which got snubbed by the SEC.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Aave

Aave  Pepe

Pepe  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS  Ondo

Ondo  Tokenize Xchange

Tokenize Xchange  USD1

USD1  Mantle

Mantle  Gate

Gate  Official Trump

Official Trump  Cosmos Hub

Cosmos Hub  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  VeChain

VeChain  Lombard Staked BTC

Lombard Staked BTC  Sky

Sky  Render

Render  POL (ex-MATIC)

POL (ex-MATIC)  Sei

Sei  Arbitrum

Arbitrum  Ethena

Ethena  Algorand

Algorand  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Filecoin

Filecoin  USDtb

USDtb  Quant

Quant  Binance-Peg WETH

Binance-Peg WETH  Worldcoin

Worldcoin  KuCoin

KuCoin  Binance Staked SOL

Binance Staked SOL  USDT0

USDT0  Jupiter

Jupiter  NEXO

NEXO  Rocket Pool ETH

Rocket Pool ETH  SPX6900

SPX6900  Kaia

Kaia  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Injective

Injective  Bonk

Bonk  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Stacks

Stacks  Fartcoin

Fartcoin  Celestia

Celestia  Sonic

Sonic  PayPal USD

PayPal USD  Virtuals Protocol

Virtuals Protocol  Optimism

Optimism  Solv Protocol BTC

Solv Protocol BTC  SyrupUSDC

SyrupUSDC