Ether Options Action Thickens With Notable Volume at $6,000-Strike Calls

Brazilian Government Proposes Overhaul of Cryptocurrency Taxation

(Originally posted on : Crypto News – iGaming.org )

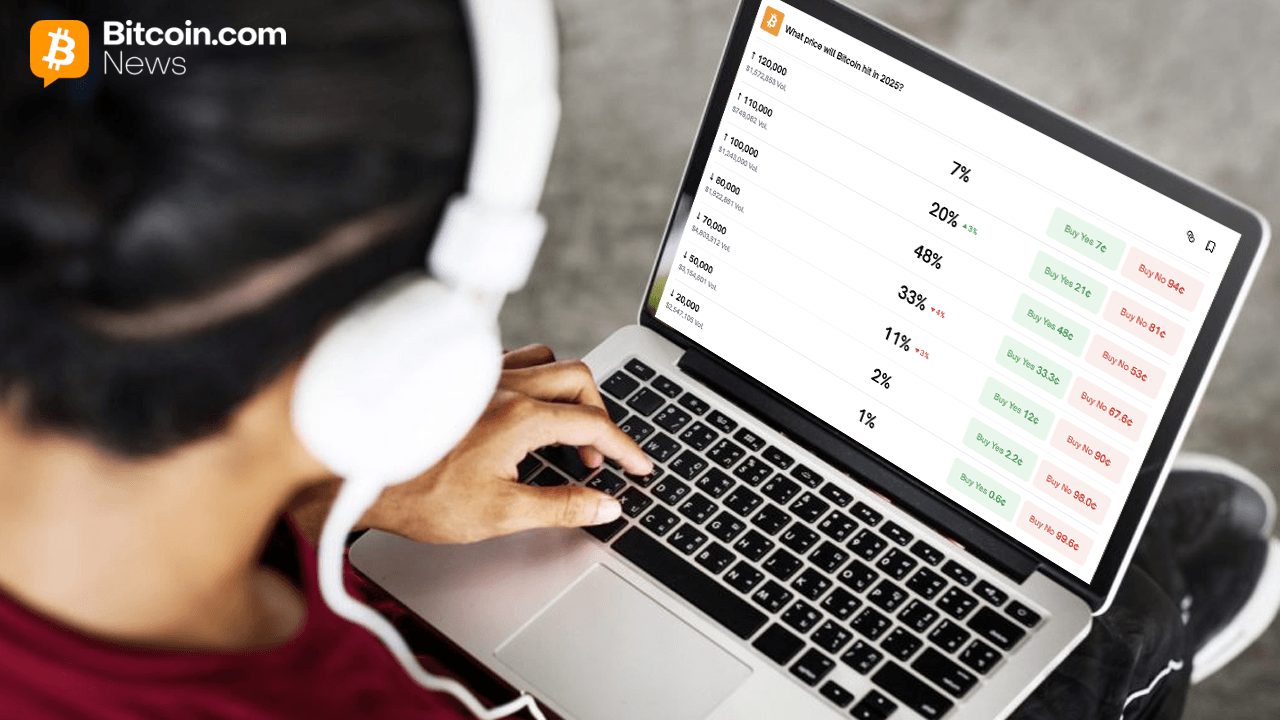

Brazil is set to introduce significant changes to its cryptocurrency taxation policies. A forthcoming bill aims to reclassify cryptocurrencies, subjecting them to taxation akin to shares and capital instruments with variable exchange rates, rather than treating them as goods.

Under the proposed legislation, cryptocurrency transactions would be subject to a flat tax rate of 15% on income generated. Presently, gains from cryptocurrency dealings are taxed as goods, with capital gains tax ranging from 15% to 22.5%, depending on transaction volumes.

Thresholds and Exemptions

The bill sets a threshold of 35,000 reais (approximately $7,000) per month for cryptocurrency and non-fungible token (NFT) transactions, exceeding which investors are liable for taxation. This threshold surpasses the current limit for stock transactions, which stands at 20,000 reais (approximately $4,000). However, it remains uncertain whether the bill will adjust these thresholds or provide exemptions for smaller cryptocurrency trades.

While the proposed changes are slated for implementation in 2025, their realization hinges on the bill’s passage through Congress. Despite being in development for over a year, the legislation’s fate remains uncertain.

The proposed tax overhaul aligns with Brazil’s broader efforts to enhance regulatory oversight of the cryptocurrency sector. In a recent development, the Brazilian crypto tax authority detected irregularities in over 25,000 cryptocurrency tax statements, leveraging both traditional and artificial intelligence methodologies for detection.

New players only. Exclusive 111% Welcome Bonus + 111 Free Spins

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Chainlink

Chainlink  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  WETH

WETH  Wrapped eETH

Wrapped eETH  Monero

Monero  Ethena USDe

Ethena USDe  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Hedera

Hedera  Avalanche

Avalanche  Sui

Sui  Shiba Inu

Shiba Inu  Dai

Dai  World Liberty Financial

World Liberty Financial  Cronos

Cronos  sUSDS

sUSDS  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  PayPal USD

PayPal USD  USDT0

USDT0  Polkadot

Polkadot  Mantle

Mantle  Canton

Canton  Bittensor

Bittensor  Aave

Aave  USD1

USD1  Bitget Token

Bitget Token  MemeCore

MemeCore  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Tether Gold

Tether Gold  Aster

Aster  Falcon USD

Falcon USD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Pi Network

Pi Network  Ethena

Ethena  Pepe

Pepe  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Pump.fun

Pump.fun  Rain

Rain  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  HTX DAO

HTX DAO  Ondo

Ondo  Worldcoin

Worldcoin  Aptos

Aptos  POL (ex-MATIC)

POL (ex-MATIC)  PAX Gold

PAX Gold  syrupUSDC

syrupUSDC  USDtb

USDtb  BFUSD

BFUSD  KuCoin

KuCoin  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Rocket Pool ETH

Rocket Pool ETH  Sky

Sky  Ripple USD

Ripple USD  Wrapped BNB

Wrapped BNB  Gate

Gate  Global Dollar

Global Dollar  Algorand

Algorand  Circle USYC

Circle USYC  Official Trump

Official Trump  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Function FBTC

Function FBTC  Lombard Staked BTC

Lombard Staked BTC  Liquid Staked ETH

Liquid Staked ETH  Solv Protocol BTC

Solv Protocol BTC