Bitcoin ETF Rally Pauses as $228 Million Outflow Hits Market

Analysis: Silver prices poised for further upside amid surging industrial demand

(Originally posted on : Invezz )

Much like gold, silver has had a stellar year so far. But, there is still room for more upside.

Silver prices on COMEX have risen 32% since the beginning of the year, outstripping gold’s returns this year.

Much like the yellow metal, silver has been buoyed by interest rate cuts by the US Federal Reserve, geopolitical tensions and investment demand.

However, the gold/silver ratio remains at a comparatively high level of 86.

“In other words, silver is still cheap compared to gold,” Carsten Fritsch, commodity analyst at Commerzbank AG, said.

At the time of writing, the March silver contract on COMEX was $31.793 per ounce, while the February gold contract was $2,669.74 an ounce.

Drivers of silver price

At the end of October, silver prices on COMEX hit a 12-year high of just under $35 per ounce.

“The price has since fallen back to just over USD 30, which would still be the highest year-end level since at least 2012,” Fritsch said.

Like gold, silver is being supported by the interest rate cuts implemented already and the prospect of further interest rate cuts by central banks.

The US Fed has already cut interest rates by 75 basis points over the course of two meetings in September and November.

Traders are expecting the bank to cut rates by a further 25 bps later this month at a policy meeting.

Fritsch said:

This is because silver is also an investment metal despite its high industrial use.

“As such, despite falling to a 4-year low this year, bars and coins still account for around one-sixth of silver demand.”

Meanwhile, both the Silver Institute and Metals Focus have forecast that demand for silver exchange-traded funds (ETFs) is likely to be positive this year.

This is in contrast to the previous two years, which saw ETF outflows, meaning that demand was negative.

Robust silver demand from industries

According to Commerzbank AG, silver demand for industrial applications, on the other hand, is “continuing to break record after record”.

Industrial applications account for almost 60% of total silver demand, the German bank said.

The driver is the demand for electrical and electronic applications, particularly from photovoltaics and e-mobility.

Meanwhile, Fritsch said that silver demand for photovoltaics has more than doubled in the last three years and now almost equals that for bars and coins.

This also meant that demand for jewelry and silverware has stagnated over the past few years.

“Rising industrial demand will ultimately ensure that physical silver demand, excluding ETFs, will also increase slightly this year and reach its second-highest level after 2022,” Fritsch added.

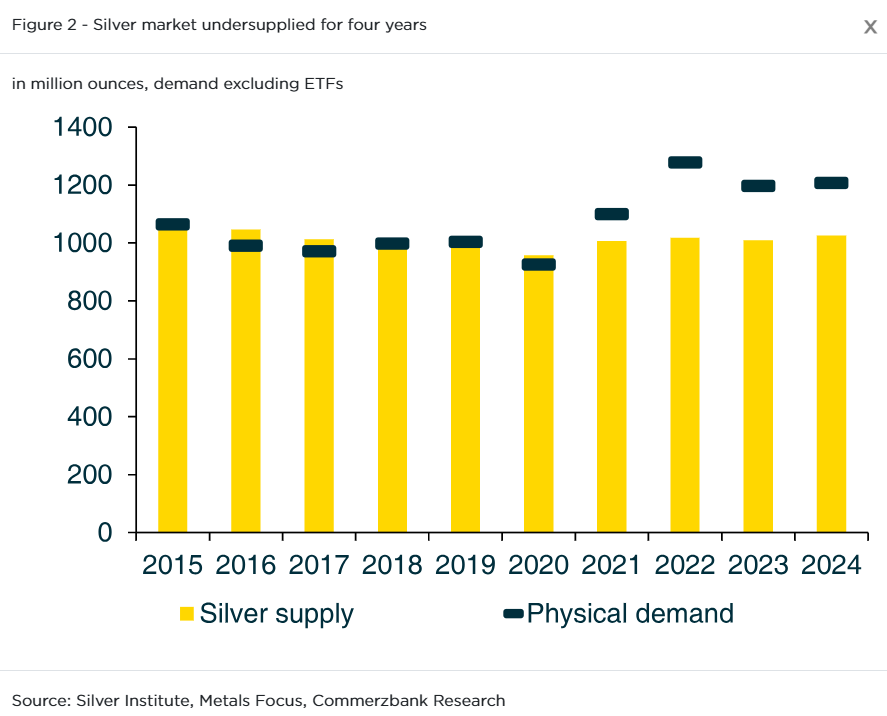

On top of this, the Silver Institute and Metals Focus forecast a considerable supply deficit in the silver market this year.

As demand from industries surged, an imbalance in the market would likely push silver prices up in the long term.

Silver supply deficit

Even as silver supply is expected to touch an 8-year high in 2024, forecasts from Metals Focus and the Silver Institute show that the market will be undersupplied by 182 million ounces.

According to Commerzbank, the 2024 deficit in supply would be slightly lower than in the previous year, and the market will be undersupplied for the fourth consecutive year.

“Taking ETF inflows into account, the deficit would even be higher than for the last four years,” Fritsch said.

Fritsch noted:

Assuming a further increase in demand for silver for industrial applications and a recovery in the recently weak physical investment demand, the deficit excluding ETFs could even be slightly larger than this year and possibly reach the record deficit of 2022, when physical demand exceeded supply by 261 million ounces.

The Silver Institute and Metals Focus also expect a supply deficit next year. But, the organizations have not yet released any figures.

Silver price outlook

Against such a bullish backdrop, the price correction in silver prices in November provided an excellent opportunity for investors to obtain more silver. Kitco.com said in a report.

“While gold has broken records all year long, attaining 39 new record high closes, silver has yet to approach its previous bull market high of $50 an ounce,” Rich Checkan, president and chief operating officer at ASI, said in a column in Kitco.com.

While silver bugs may be disappointed, it is important to note that historically, silver tends to lag behind gold well into a bull market cycle, before overtaking gold’s gains explosively.

Checkan said that this makes the “perceived lethargy” in silver prices currently a perfect opportunity for investors.

Considering the deficit in supply, Commerzbank expects silver prices to rise to $32 per ounce by the middle of 2025 and hit $33 by the end of next year.

As a result, the German bank also expects the gold/silver ratio to fall to 80 by the end of 2025.

The post Analysis: Silver prices poised for further upside amid surging industrial demand appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Figure Heloc

Figure Heloc  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Monero

Monero  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Dai

Dai  sUSDS

sUSDS  Hedera

Hedera  PayPal USD

PayPal USD  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Sui

Sui  Zcash

Zcash  WETH

WETH  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Pi Network

Pi Network  Falcon USD

Falcon USD  Global Dollar

Global Dollar  Bittensor

Bittensor  Aster

Aster  Aave

Aave  Sky

Sky  syrupUSDC

syrupUSDC  NEAR Protocol

NEAR Protocol  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Midnight

Midnight  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Ondo US Dollar Yield

Ondo US Dollar Yield  Quant

Quant  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  OUSG

OUSG  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund