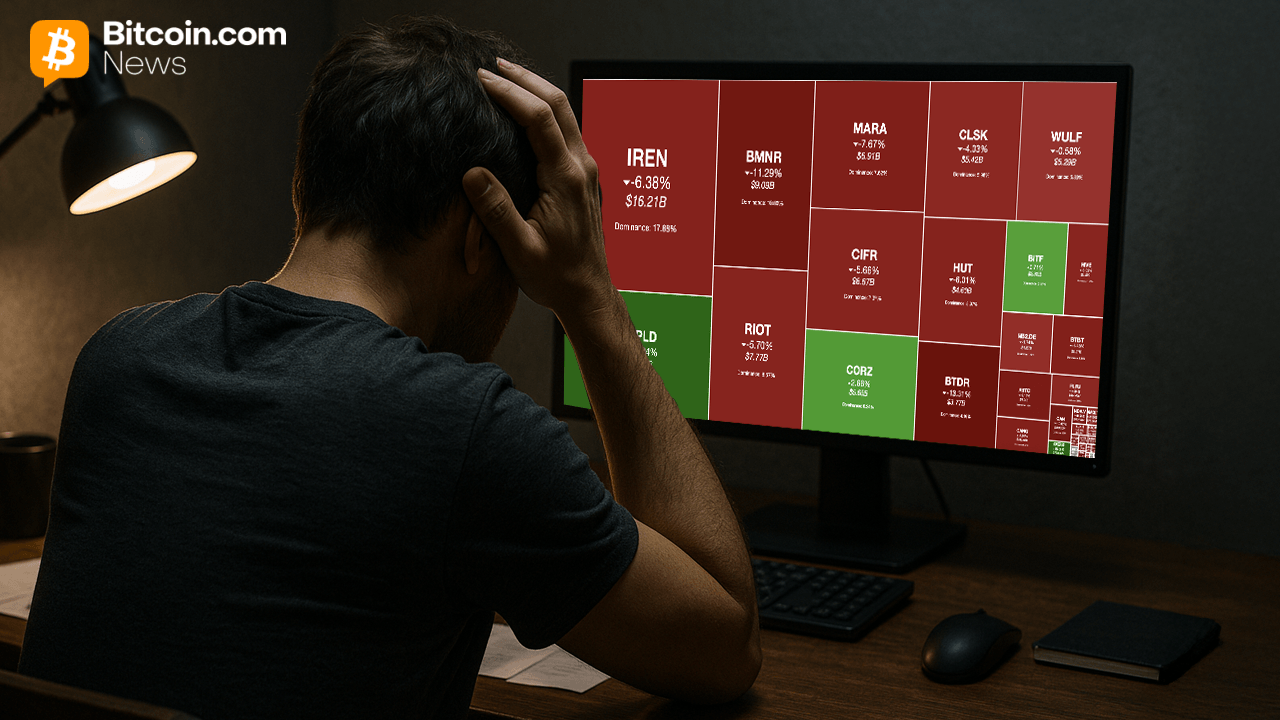

Bitcoin Mining Stocks Plunge as $1.65 Trillion Is Wiped From

Dudley Warns Bitcoin Reserve Would Increase Inflation and Add to National Debt

(Originally posted on : Crypto News – iGaming.org )

A former Federal Reserve leader has voiced strong opposition to the idea of establishing a Bitcoin (BTC)-backed strategic reserve. Bill Dudley, ex-president of the Federal Reserve Bank of New York and former vice-chair of the Federal Open Market Committee (FOMC), argues that such a move would harm the economy.

Dudley Warns Against Inflation and Debt

In an opinion piece for Bloomberg, Dudley criticized the Trump administration’s proposed Bitcoin reserve, calling it a plan with “zero positives.” He warned that it would lead to rising inflation and increased national debt.

“But what benefit does establishing a Bitcoin reserve have for the government or those who do not hold Bitcoin? None,” Dudley remarked. He added that the reserve would force the government to hold a volatile asset that generates no revenue, creating more financial instability.

According to Dudley, funding a Bitcoin reserve would require the Treasury to either borrow more money, raising debt service costs, or rely on the Federal Reserve to print money, further fueling inflation. He likened the latter to monetizing government debt, a practice that has sparked significant debate in economic circles.

While rejecting the Bitcoin reserve concept, Dudley called for regulatory clarity to support the broader cryptocurrency industry. He urged the government to develop clear definitions of digital tokens as either securities or currencies.

New players only. Exclusive Welcome Bonus of up to $2,500

Dudley emphasized the importance of consumer protection and measures to prevent illicit activities like terrorism financing and drug trafficking. “If the administration truly wants to support Bitcoin and the crypto industry, it should focus on creating laws and regulations that allow it to develop and operate safely,” he wrote.

Dudley’s comments highlight the challenges of integrating cryptocurrencies into national financial systems. He believes that fostering innovation through thoughtful regulation is a more effective approach than adopting Bitcoin as a government-backed reserve.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Figure Heloc

Figure Heloc  Ethena USDe

Ethena USDe  Chainlink

Chainlink  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  Avalanche

Avalanche  Sui

Sui  LEO Token

LEO Token  WETH

WETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  USDS

USDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC  USDT0

USDT0  Litecoin

Litecoin  Hedera

Hedera  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Monero

Monero  Cronos

Cronos  Toncoin

Toncoin  Mantle

Mantle  Zcash

Zcash  Dai

Dai  Polkadot

Polkadot  MemeCore

MemeCore  OKB

OKB  Aave

Aave  Uniswap

Uniswap  World Liberty Financial

World Liberty Financial  Bitget Token

Bitget Token  Pepe

Pepe  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  USD1

USD1  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  Aptos

Aptos  PayPal USD

PayPal USD  Currency One USD

Currency One USD  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Binance-Peg WETH

Binance-Peg WETH  sUSDS

sUSDS  Aster

Aster  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Binance Staked SOL

Binance Staked SOL  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Gate

Gate  KuCoin

KuCoin  USDtb

USDtb  Story

Story  Internet Computer

Internet Computer  BFUSD

BFUSD  Rocket Pool ETH

Rocket Pool ETH  Pi Network

Pi Network  Arbitrum

Arbitrum  Algorand

Algorand  Falcon USD

Falcon USD  Tether Gold

Tether Gold  Cosmos Hub

Cosmos Hub  Wrapped BNB

Wrapped BNB  Kinetiq Staked HYPE

Kinetiq Staked HYPE  VeChain

VeChain  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Sky

Sky  Pump.fun

Pump.fun  Liquid Staked ETH

Liquid Staked ETH  Lombard Staked BTC

Lombard Staked BTC  ChainOpera AI

ChainOpera AI  Sei

Sei  Quant

Quant  Render

Render  PAX Gold

PAX Gold  Renzo Restaked ETH

Renzo Restaked ETH  NEXO

NEXO