Crypto.com Executive Confident Courts Will Uphold CFTC Jurisdiction Over Prediction

Animoca Brands Seeks Broad Altcoin Exposure for Future Public Listing

(Originally posted on : Crypto News – iGaming.org )

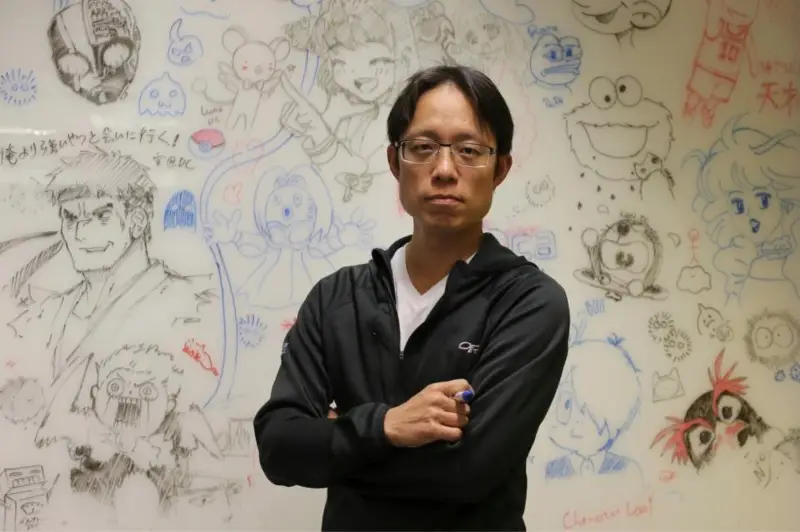

nimoca Brands founder Yat Siu outlined the company strategy to give investors broader exposure to altcoin projects, Web3 applications, and emerging crypto sectors. The comments were reported by Cointelegraph following an interview with Siu, who confirmed that Animoca intends to go public through a reverse merger next year.

Good to Know

- Siu stated that Animoca aims to position itself as a diversified altcoin investment vehicle

- The company intends to pursue a public listing via reverse merger

- Gaming accounts for the largest portion of Animoca investment portfolio

Siu told Cointelegraph that he views altcoins as a collective asset class with the potential to outperform Bitcoin over the long term. He compared Bitcoin to gold, noting that no individual company matches gold market capitalization, yet the combined market value of all public companies surpasses gold by a wide margin.

“We believe that altcoins, ultimately, over the largest space, are going to outperform Bitcoin as a collective,” Siu said.

He noted that Bitcoin serves primarily as a reserve asset for Animoca, rather than a tool for daily use within the company investment operations.

New players only. Exclusive Welcome Bonus of up to $2,500

“We don’t join crypto because we want to hold Bitcoin, only holding Bitcoin as a reserve asset, but I don’t use it, right?” Siu said, highlighting the broad utility of altcoins across gaming, DeFi, gas fees, and decentralized physical infrastructure networks.

Altcoins as the Equivalent of Early Internet Growth Companies

Siu described most Web3 applications as altcoins in functional terms. He added that even memecoins fall under that definition, despite their limited utility. Animoca intends to build a diversified treasury spanning a wide range of crypto assets connected to Web3 ecosystems.

“All of these applications are actually altcoins, right in the classical definition, even, you know, to a lesser extent, but perhaps even more meaningfully, before, memecoins are also altcoins,” he said.

Siu drew a comparison between Animoca current investment strategy and early-stage opportunities during the rise of the internet. He referenced Amazon, Google, eBay, and Alibaba as examples of major companies that benefited from widespread investor exposure in the early 2000s.

New players only. Exclusive 111% Welcome Bonus + 111 Free Spins

“We feel that we’re pretty well positioned for that,” he said, explaining that the crypto sector is unlikely to produce a single dominant project.

Capturing Future Crypto Leaders

Animoca intends to maintain a broad investment footprint across sectors in order to capture future high-performing projects. Siu said the size of Animoca portfolio increases the probability of holding exposure to successful assets and protocols.

Gaming remains the largest category within Animoca investments, representing 230 of the company 628 portfolio holdings. Other sectors such as infrastructure, artificial intelligence, and decentralized finance continue to expand within its investment mix.

Siu told Cointelegraph that Animoca can access altcoins at much earlier stages and lower valuations than general investors and intends to transfer that benefit to shareholders.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  WETH

WETH  Wrapped eETH

Wrapped eETH  Monero

Monero  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Hedera

Hedera  Sui

Sui  Shiba Inu

Shiba Inu  Dai

Dai  World Liberty Financial

World Liberty Financial  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  USDT0

USDT0  sUSDS

sUSDS  Uniswap

Uniswap  PayPal USD

PayPal USD  Polkadot

Polkadot  Mantle

Mantle  Canton

Canton  Bittensor

Bittensor  Aave

Aave  USD1

USD1  Bitget Token

Bitget Token  NEAR Protocol

NEAR Protocol  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  Falcon USD

Falcon USD  Aster

Aster  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  MemeCore

MemeCore  Pi Network

Pi Network  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  Pepe

Pepe  Binance-Peg WETH

Binance-Peg WETH  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Wrapped SOL

Wrapped SOL  Pump.fun

Pump.fun  Rain

Rain  Aptos

Aptos  Ondo

Ondo  HTX DAO

HTX DAO  Worldcoin

Worldcoin  KuCoin

KuCoin  POL (ex-MATIC)

POL (ex-MATIC)  PAX Gold

PAX Gold  syrupUSDC

syrupUSDC  USDtb

USDtb  BFUSD

BFUSD  Rocket Pool ETH

Rocket Pool ETH  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Ripple USD

Ripple USD  Official Trump

Official Trump  Gate

Gate  Wrapped BNB

Wrapped BNB  Arbitrum

Arbitrum  Global Dollar

Global Dollar  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Filecoin

Filecoin  Binance Staked SOL

Binance Staked SOL  Circle USYC

Circle USYC  Function FBTC

Function FBTC  Sky

Sky  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Lombard Staked BTC

Lombard Staked BTC  Liquid Staked ETH

Liquid Staked ETH