Crypto Goes Mainstream as Standard Chartered Deepens Digital Asset Push

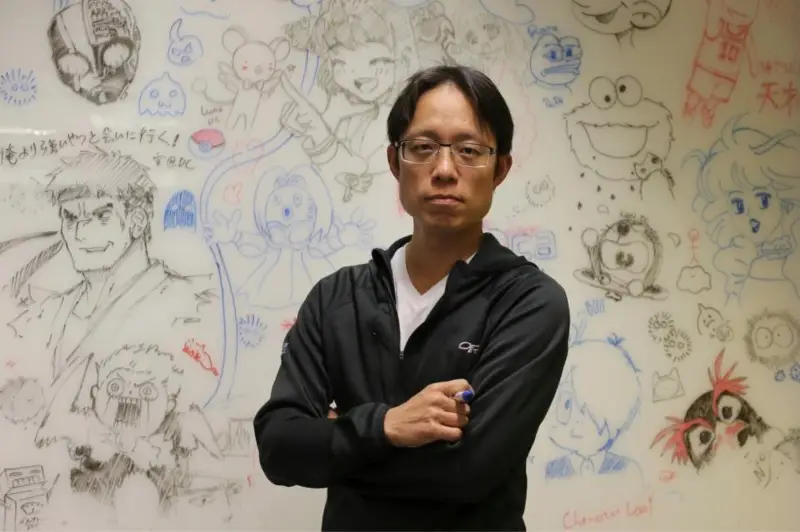

Animoca Chair Yat Siu Maps Web3 Direction For 2026

(Originally posted on : Crypto News – iGaming.org )

Crypto prices remain under pressure heading into 2026, yet a longer-term view from Animoca Brands leadership points to a different trajectory for Web3. Yat Siu outlines where capital, users, and utility may concentrate as regulation and adoption evolve.

Good to Know

- Yat Siu expects altcoins to outpace Bitcoin in utility growth

- Regulation clarity may unlock corporate token adoption

- Tokenization could reshape finance, media, and digital ownership

Altcoins May Outpace Bitcoin In Utility

Yat Siu, co-founder and executive chairman of Animoca Brands, shared a detailed outlook for Web3 in 2026 that leans away from short-term market sentiment. His analysis frames the next phase around usability, regulation, and financial access rather than price cycles.

Bitcoin continues to hold a specific role. Siu described it as firmly positioned as a store of value. At the same time, he sees the broader token market carrying most of the innovation.

“Bitcoin has cemented its status as digital gold,” Siu wrote. “However, it is the broader altcoin market that represents global innovation and utility.”

New players only. Exclusive Welcome Bonus of 177% + 77 Free Spins

He compared that structure to traditional finance, where gold dominates individually but public companies collectively account for far more economic value. According to Siu, many users enter crypto through utility-driven tokens tied to gaming, decentralized finance, or digital ownership rather than through Bitcoin itself.

“The growth of the altcoin market in recent years signals that there will be opportunities in already launched tokens and not just new tokens,” he said.

Siu also pointed to historical parallels following the dotcom crash. He argued that Web3 now sits in a phase where existing projects with liquidity may outperform speculative launches.

“Once upon a time in Web3, most of the opportunity lay in hotly anticipated tokens that were about to launch,” he said. “That is no longer the case.”

New players only. Exclusive Welcome Bonus of 350% + 150 Free Spins

Regulation And Institutions Shape The Next Phase

Regulation remains a central theme in the outlook. Siu referenced recent US legislative developments, including stablecoin frameworks and proposed clarity around regulatory oversight.

“While the GENIUS Act provided an initial legal framework for stablecoins, the industry also gained much-needed guidance with the proposed Clarity Act,” he wrote.

He added that clearer jurisdiction between regulators could unlock tokenization across many industries.

“We believe the Clarity Act will pass Congress in 2026 and will trigger a wave of tokenization for many types of companies in the US, both large and small.”

Institutional participation also features heavily. Siu sees the next growth phase defined by real-world assets and stablecoins rather than speculative trading.

“What started with the introduction of crypto ETFs will become a full and continued thematic around broad institutional adoption,” he said.

New players only. Exclusive 111% Welcome Bonus + 111 Free Spins

Tokenized assets may also expand access to financial tools that traditional systems fail to reach.

“RWAs and other financialized assets will provide users with much more democratic access,” Siu wrote, citing faster payments, better yield access, and tools for unbanked populations.

Utility Replaces Hype As Web3 Reaches New Users

On user experience, Siu expects blockchain to fade into the background.

“Today, we no longer say digital music or MP3, we just say music,” he said. “The same will happen with blockchain functionality.”

He pointed to prediction markets, gaming assets, and yield products already using crypto rails without requiring users to engage directly with blockchain mechanics.

Looking ahead, Siu expects a shift in audience focus.

“In 2026 crypto will see a shift from crypto natives to the crypto curious,” he wrote. “And a shift from fun and entertainment to utility and value.”

That transition may allow tokens to communicate purpose more clearly.

“Under a more friendly regulatory framework, it becomes possible to discuss the value and utility of tokens more directly,” Siu said.

He also stressed the role of education as tokenization spreads.

“Tokenization leads to financialization,” he wrote. “Users need greater financial literacy to benefit from new opportunities.”

Siu closed his outlook with a warning tied to adoption pressure.

“Tokenize or die,” he wrote. “Companies that do not tokenise their assets will become less relevant.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Monero

Monero  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Zcash

Zcash  Litecoin

Litecoin  sUSDS

sUSDS  Hedera

Hedera  Dai

Dai  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Sui

Sui  WETH

WETH  Toncoin

Toncoin  Rain

Rain  Cronos

Cronos  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Aster

Aster  Falcon USD

Falcon USD  Bittensor

Bittensor  Bitget Token

Bitget Token  OKB

OKB  Pepe

Pepe  Sky

Sky  Circle USYC

Circle USYC  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Pi Network

Pi Network  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Worldcoin

Worldcoin  KuCoin

KuCoin  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Quant

Quant  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Ethena

Ethena  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Algorand

Algorand  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin