Bananatech Expands Crypto Card Infrastructure to Support Fintech and Web3

Blockchain Adoption Linked to Dissatisfaction with Finance Systems

(Originally posted on : Crypto News – iGaming.org )

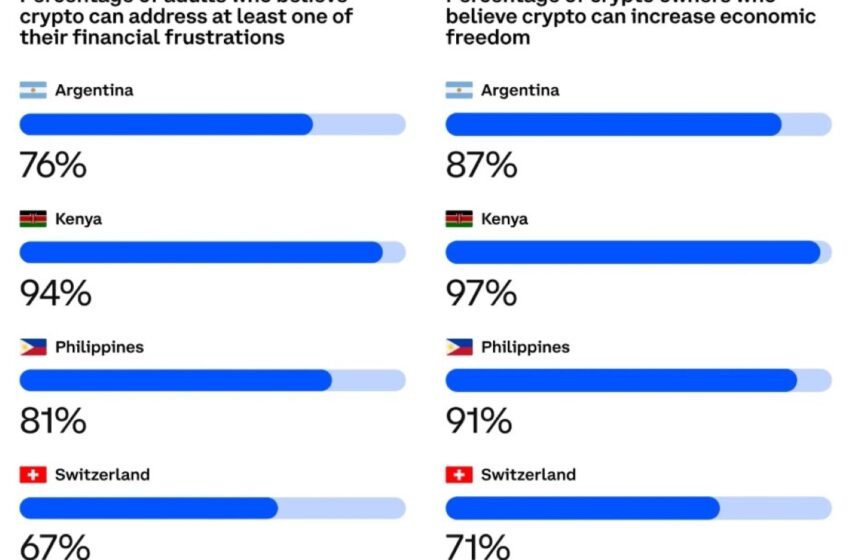

Coinbase has released its latest State of Crypto report, developed in collaboration with Ipsos, to examine how blockchain technology and cryptocurrencies are perceived in Argentina, Kenya, the Philippines, and Switzerland. The study highlights the role of crypto in addressing financial challenges across these countries, each with unique socioeconomic conditions.

The survey collected responses from 4,000 adults in the four countries, chosen to reflect diverse geographic, cultural, and economic backgrounds. Despite their differences, these countries share a common perspective: dissatisfaction with their financial systems and a belief that blockchain and crypto could provide solutions.

Perceptions of Financial Systems

The report reveals that less than half of the respondents in all four countries believe their financial systems will improve their lives compared to the previous generation. In Argentina and the Philippines, people feel their current financial situation is slightly better than before, though far from ideal. In contrast, respondents in Kenya and Switzerland are more critical of recent financial developments, preferring earlier systems.

Across all countries, financial systems were described as “slow,” “expensive,” and “unstable.” Respondents cited challenges such as a lack of innovation, unfair practices, and the devaluation of their national currencies. Other concerns included excessive centralization and the difficulty of earning and saving money.

Crypto as a Tool for Change

Many respondents see crypto and blockchain technology as a way to gain greater financial independence and control. Around 70% of those surveyed believe digital currencies can help achieve these goals. Both crypto owners and non-owners view blockchain as a tool to improve financial systems by making them faster, more accessible, and innovative.

Kenya and the Philippines showed the strongest interest in crypto, particularly as a means to combat centralization, discrimination, and economic hardships. Argentina’s respondents expressed concerns about trust in financial institutions and saving money. In Switzerland, the appetite for crypto was lower, though 70% of crypto users in the country felt it gave them more financial freedom and control.

Challenges and Opportunities

The report highlights a link between dissatisfaction with financial systems and support for blockchain technology. Countries like Kenya and the Philippines, where access to traditional banking services is limited, view crypto as a viable alternative. In contrast, Switzerland, where financial systems are relatively stable, shows less urgency for adopting blockchain solutions.

Most respondents agreed that broader blockchain adoption could benefit individual wealth and improve financial systems. Many believe that the technology promotes innovation while giving individuals more control over their finances.

A Regional Divide

Switzerland stands out in the report with lower interest in cryptocurrencies and blockchain compared to the other three countries. This reflects greater satisfaction with its financial system and lower reliance on alternatives like crypto. On the other hand, Kenya’s growing smartphone penetration and limited banking access make it a leading region for adopting blockchain-based solutions.

The post Blockchain Adoption Linked to Dissatisfaction with Finance Systems appeared first on iGaming.org.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Figure Heloc

Figure Heloc  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Ethena USDe

Ethena USDe  Wrapped Bitcoin

Wrapped Bitcoin  Canton

Canton  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Dai

Dai  sUSDS

sUSDS  Hedera

Hedera  PayPal USD

PayPal USD  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Sui

Sui  Toncoin

Toncoin  Cronos

Cronos  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Falcon USD

Falcon USD  Aave

Aave  Aster

Aster  Pepe

Pepe  Global Dollar

Global Dollar  Bittensor

Bittensor  Circle USYC

Circle USYC  Ripple USD

Ripple USD  OKB

OKB  Bitget Token

Bitget Token  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Sky

Sky  Pi Network

Pi Network  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  POL (ex-MATIC)

POL (ex-MATIC)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Internet Computer

Internet Computer  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  Pump.fun

Pump.fun  Cosmos Hub

Cosmos Hub  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Quant

Quant  USDtb

USDtb  pippin

pippin  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Ethena

Ethena  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  OUSG

OUSG  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  USDD

USDD  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund