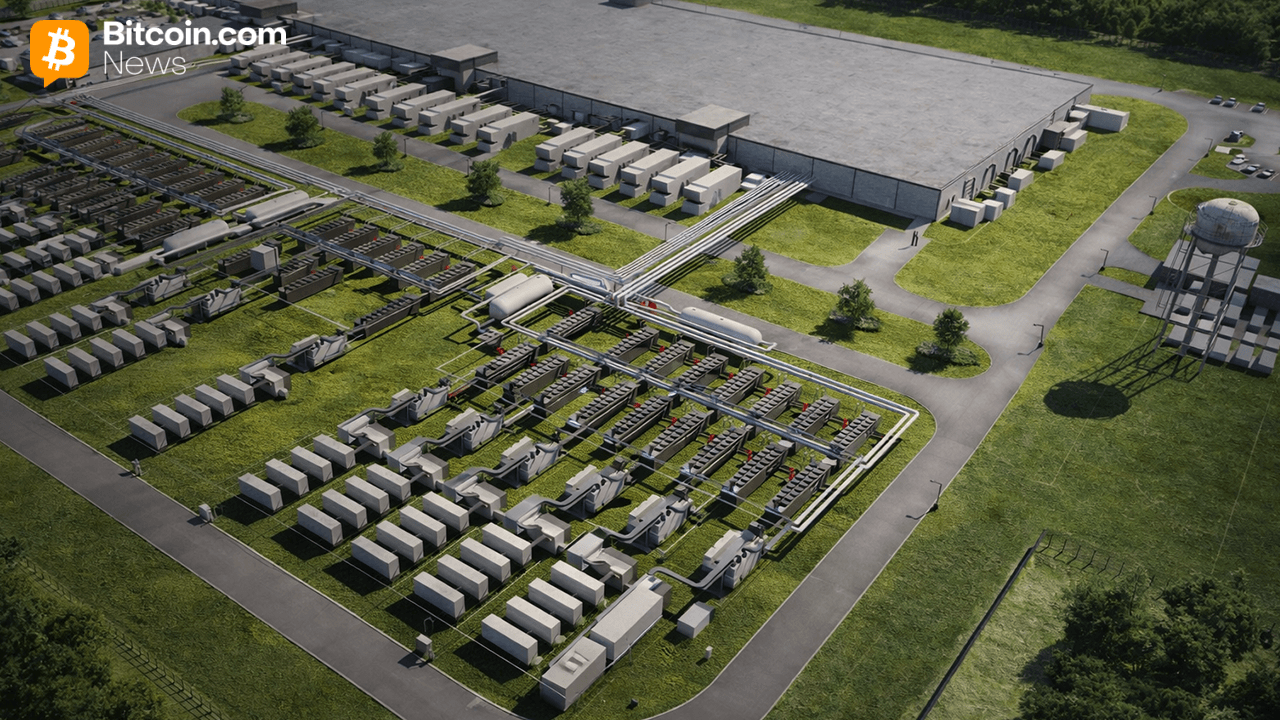

Morgan Stanley Backs Core Scientific With up to $1B Financing

Cryptocurrency Exchange FTX Faces Complete Liquidation Between Legal Struggles

(Originally posted on : Crypto News – iGaming.org )

The cryptocurrency exchange FTX, which filed for bankruptcy in November 2022, has made the decision to sell up its holdings in order to pay back its debts to customers. At a recent Delaware bankruptcy court hearing, FTX’s counsel, Andy Dietderich, disclosed the decision.

A number of legal issues and disputes, including accusations of fraud against FTX’s founder, Sam Bankman-Fried, have accompanied the company’s declaration of bankruptcy. FTX decided to liquidate due to administrative and financial difficulties, notwithstanding its original intentions to resume operations.

Recovery Efforts and Asset Valuation Disputes

The company’s lack of sustainable technology and management was highlighted by the failure of attempts to attract investors or purchasers for FTX. But FTX has been able to retrieve more than $7 billion in assets for the reimbursement of customers. A repayment scheme that prioritizes complete consumer reimbursement over the estimated $9 billion in outstanding claims has been developed in cooperation with government agencies.

A disagreement centers on how these repayments should be valued; FTX chose to use bitcoin values from November 2022, a time when the market was at its lowest. Since then, the value of cryptocurrencies, such as Bitcoin (BTC), has increased, which has left some consumers unhappy. U.S. Bankruptcy Judge John Dorsey maintained this valuation method in spite of criticism, placing a strong emphasis on compliance with U.S. bankruptcy law.

The judge emphasized the strict Bankruptcy Code requirements in this particular legal context, which include the necessity for debt value at the time of the company’s bankruptcy petition. This ruling clarifies FTX’s complicated legal position and opens the door for the liquidation procedure to be completed for client reimbursements to follow.

New players only. Exclusive Welcome Bonus of 350% + 150 Free Spins

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Figure Heloc

Figure Heloc  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Monero

Monero  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Hedera

Hedera  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Zcash

Zcash  Sui

Sui  WETH

WETH  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Circle USYC

Circle USYC  Pi Network

Pi Network  Sky

Sky  Aster

Aster  Bittensor

Bittensor  Aave

Aave  Falcon USD

Falcon USD  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  NEAR Protocol

NEAR Protocol  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Ethena

Ethena  Ondo US Dollar Yield

Ondo US Dollar Yield  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Filecoin

Filecoin  Wrapped BNB

Wrapped BNB  Official Trump

Official Trump  Function FBTC

Function FBTC