Samourai Wallet Co-Founder William Hill Gets 4-Year Federal Sentence

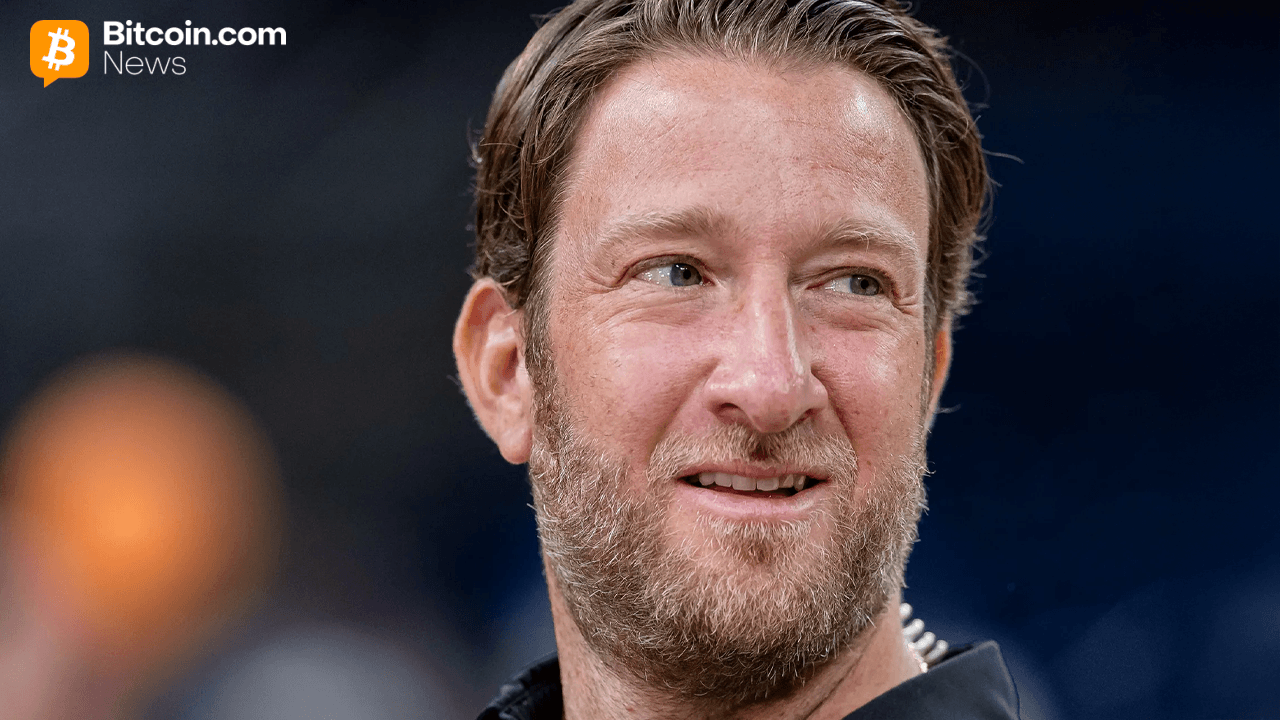

Fundstrat’s Tom Lee Says Bitcoin May Reach $250K In 2025

(Originally posted on : Crypto News – iGaming.org )

Bitcoin could be in for a wild ride before the year wraps up—at least if you ask Tom Lee. The Fundstrat co-founder and head of research believes Bitcoin might climb to as high as $250,000 in the coming months, supported by rising interest in crypto and comparisons to gold.

Good to know

- Lee sees Bitcoin hitting $200K to $250K in 2025.

- He says Ethereum will benefit from the rise of stablecoins.

- Bitcoin trades at around $117,498 at the time of writing (via CoinMarketCap).

In a recent CNBC interview, Lee explained that Bitcoin’s valuation still has room to grow when compared to the gold market. “I think the $200,000 to $250,000 range for Bitcoin still makes sense, because that would still only value it at 25% of the size of the gold market,” he said. He added that Bitcoin could eventually be worth over $1 million per coin. “That could happen in the next few years, but maybe pricing in 25% of that—especially with the Genius Act—makes sense.”

Lee’s outlook leans on the idea of Bitcoin as digital gold—a concept that many long-term crypto investors support. But his forecast is not just about Bitcoin. He also shared views on the growing importance of stablecoins and how they might influence the crypto ecosystem, particularly Ethereum.

“Stablecoins are the ChatGPT moment for crypto,” Lee said, pointing out that both consumers and businesses are adopting them quickly. He mentioned that financial giants like JPMorgan and Citi are starting to embrace the stablecoin space. According to Lee, the Genius Act has played a role in making this shift happen.

New players only. Exclusive 111% Welcome Bonus + 111 Free Spins

When asked how to position for that trend, he acknowledged Circle’s role but pointed more strongly toward Ethereum. “Ethereum is really the way to play stablecoins, because the majority of stablecoins are created on Ethereum,” he explained. Lee noted that stablecoin activity now accounts for over 30% of Ethereum’s network fees.

He also referenced investor Scott Benson, who believes the stablecoin market is approaching a $4 trillion valuation. If that figure continues to climb, Ethereum could see major growth as a result.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Zcash

Zcash  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  WETH

WETH  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Monero

Monero  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Sui

Sui  Shiba Inu

Shiba Inu  Uniswap

Uniswap  Dai

Dai  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  MemeCore

MemeCore  Mantle

Mantle  PayPal USD

PayPal USD  Canton

Canton  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  USD1

USD1  Aster

Aster  Internet Computer

Internet Computer  Aave

Aave  Currency One USD

Currency One USD  Bitget Token

Bitget Token  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Ethereum Classic

Ethereum Classic  Falcon USD

Falcon USD  Tether Gold

Tether Gold  Aptos

Aptos  Pepe

Pepe  Ethena

Ethena  Pi Network

Pi Network  Jito Staked SOL

Jito Staked SOL  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Pump.fun

Pump.fun  Binance-Peg WETH

Binance-Peg WETH  Wrapped SOL

Wrapped SOL  Ondo

Ondo  HTX DAO

HTX DAO  Worldcoin

Worldcoin  KuCoin

KuCoin  POL (ex-MATIC)

POL (ex-MATIC)  Official Trump

Official Trump  PAX Gold

PAX Gold  Filecoin

Filecoin  Algorand

Algorand  USDtb

USDtb  BFUSD

BFUSD  Cosmos Hub

Cosmos Hub  Rocket Pool ETH

Rocket Pool ETH  syrupUSDC

syrupUSDC  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Arbitrum

Arbitrum  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Gate

Gate  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Wrapped BNB

Wrapped BNB  Circle USYC

Circle USYC  syrupUSDT

syrupUSDT  Global Dollar

Global Dollar  Starknet

Starknet  Sky

Sky  Ripple USD

Ripple USD  Function FBTC

Function FBTC  Lombard Staked BTC

Lombard Staked BTC