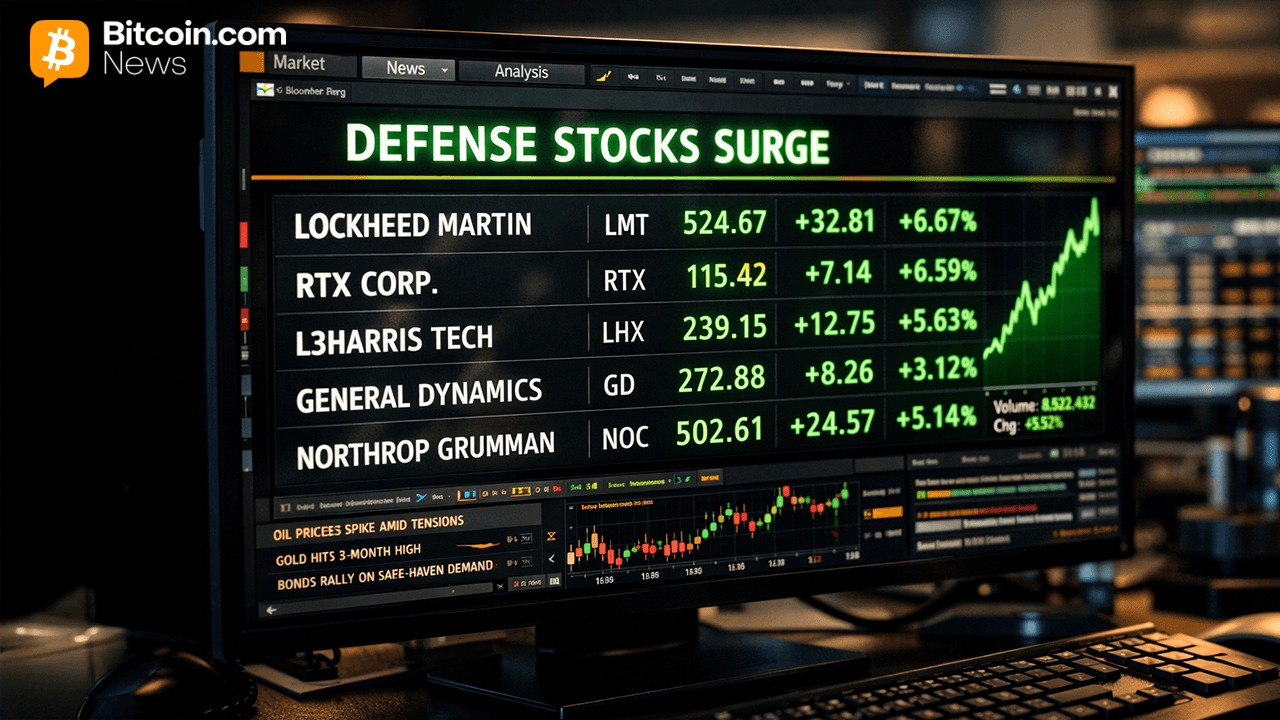

Wall Street Dumps Tech, Rotates Hard into War Economy Names;

Goldman Sachs Predicts Gradual Impact of Spot Bitcoin ETFs on BTC

(Originally posted on : Crypto News – iGaming.org )

Leading global investment bank, Goldman Sachs, has shared insights on the future of Bitcoin and the impact of potential spot bitcoin ETFs. Mathew McDermott, the head of Goldman’s digital asset unit, in a recent interview with Reuters, downplayed the possibility of a rapid increase in Bitcoin prices following the approval of these ETFs by the U.S. Securities and Exchange Commission (SEC). He believes that while the approval might not lead to an immediate spike in liquidity and price, it could draw new institutional investors.

McDermott stated, “This ability to actually transact a product that people are familiar with and can provide scale, I think is very positive.”

Currently, Goldman Sachs offers cryptocurrency derivatives trading for its institutional clients. This service is part of the bank’s FX desk, though they don’t trade the underlying asset. McDermott noted a rise in client interest in crypto derivatives, spurred by the anticipation of the SEC approving spot bitcoin ETFs. Despite acknowledging that the crypto market is relatively small, he observed increased excitement and interest in it.

Beyond cryptocurrencies, McDermott’s focus extends to the broader spectrum of digital assets, including the development of blockchain-based tokens for traditional assets like bonds. He sees a significant and growing interest in digital assets and believes that blockchain technology can improve operational and settlement efficiencies, thereby reducing risks in financial markets.

“Probably within the next one to two years you’ll see a big significant uptick in the quantum trading on-chain, probably three to five years to really see these marketplaces at scale.”

250% Extra + $125 Free Chip!New players only. Exclusive Welcome Bonus of 250% + $125 Free Chip

Looking ahead, McDermott anticipates a substantial increase in on-chain trading in the next one to two years and expects these marketplaces to scale up in three to five years. However, he is cautious about the possibility of blockchain completely replacing traditional financial markets in the near future.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Monero

Monero  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Ethena USDe

Ethena USDe  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Hedera

Hedera  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Zcash

Zcash  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Cronos

Cronos  Toncoin

Toncoin  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Aave

Aave  Bittensor

Bittensor  Global Dollar

Global Dollar  Aster

Aster  Falcon USD

Falcon USD  NEAR Protocol

NEAR Protocol  Sky

Sky  OKB

OKB  syrupUSDC

syrupUSDC  Pi Network

Pi Network  Ripple USD

Ripple USD  Pepe

Pepe  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Ondo US Dollar Yield

Ondo US Dollar Yield  Jito Staked SOL

Jito Staked SOL  Quant

Quant  NEXO

NEXO  USDtb

USDtb  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Filecoin

Filecoin  Wrapped BNB

Wrapped BNB  Aptos

Aptos