Overhead Resistance Stacks up — Bitcoin’s Next Expansion Move Could

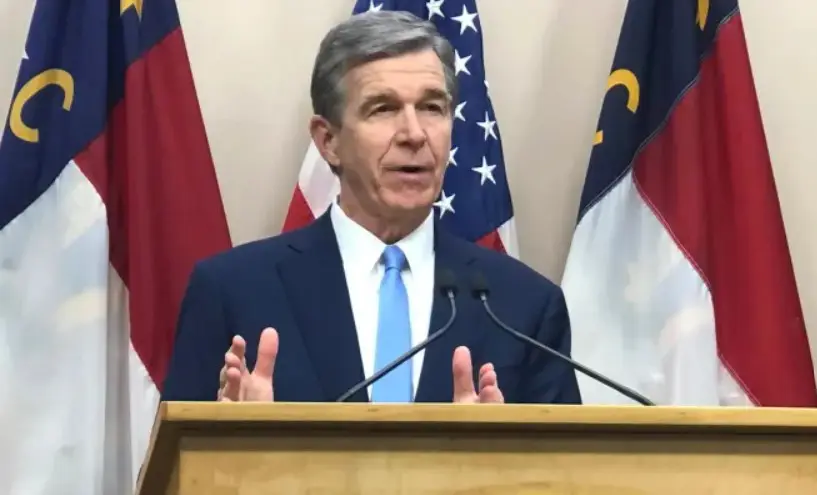

Governor Cooper Vetoes CBDC Ban During Legislative Support

(Originally posted on : Crypto News – iGaming.org )

Governor Roy Cooper of North Carolina has vetoed a bill intended to prevent the state from adopting a digital currency produced by the US Federal Reserve called a central bank digital currency (CBDC). Cooper felt the bill was “premature, vague, and reactionary,” which is why he decided on June 5 not to sign it into law even though it had received substantial support in both legislative chambers.

With 109-4 votes in the House and 39-5 votes in the Senate, House Bill 690, which sought to forbid the state from establishing a CBDC, was passed with great support. But among lawmakers and proponents of the sector, Cooper’s veto has sparked controversy and disappointment.

Political Motivations Questioned

Many critics argue that Cooper’s veto was politically driven. Representative Julia Howard expressed frustration, accusing Cooper of being “unwilling to put partisan politics aside” for the good of North Carolinians. Dan Spuller, head of industry affairs at the Blockchain Association, echoed this sentiment, describing the veto as a missed opportunity for the state to oppose the implementation of a CBDC.

Despite this backlash, there is potential for the legislature to override the veto. A three-fifths majority in both chambers could achieve this, given the bill’s initial strong support.

Federal Reserve Chair Jerome Powell has stated that the US is not close to adopting a CBDC. In a Senate Banking Committee hearing in March, Powell remarked that the country was “nowhere near recommending or adopting a CBDC in any form.” Despite these assurances, the topic remains contentious.

New players only. Exclusive Welcome Bonus of 177% + 77 Free Spins

Proponents of the ban argue that a CBDC could lead to increased government surveillance and control over financial transactions. They fear that privacy and financial autonomy could be compromised. Conversely, opponents of the ban believe these concerns are premature, given the current stage of CBDC development.

The strong legislative support for House Bill 690 reflects a growing unease about the potential implications of a CBDC. Many legislators and constituents are wary of how a federally issued digital currency could affect privacy and financial freedom.

It is unclear what the legislature of North Carolina will do in the future. They might try to override Cooper’s veto in order to publicly criticize CBDCs. The nationwide discussion concerning the future of digital currencies and government regulation is reflected in this debate in North Carolina.

A contentious discussion has been sparked by Governor Cooper’s veto, underscoring the difficulties and disagreements surrounding the regulation of digital currencies. Although CBDCs’ future in the US is still uncertain, talks in North Carolina shed light on the more significant problems that states and federal organizations are facing as they attempt to manage the rapidly changing world of digital finance.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Monero

Monero  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Hedera

Hedera  sUSDS

sUSDS  Dai

Dai  Zcash

Zcash  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Sui

Sui  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Falcon USD

Falcon USD  Aster

Aster  Pepe

Pepe  Bittensor

Bittensor  OKB

OKB  Global Dollar

Global Dollar  Bitget Token

Bitget Token  Circle USYC

Circle USYC  Ripple USD

Ripple USD  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Pi Network

Pi Network  Sky

Sky  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Pump.fun

Pump.fun  Internet Computer

Internet Computer  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Worldcoin

Worldcoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  NEXO

NEXO  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  USDD

USDD  Render

Render  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC