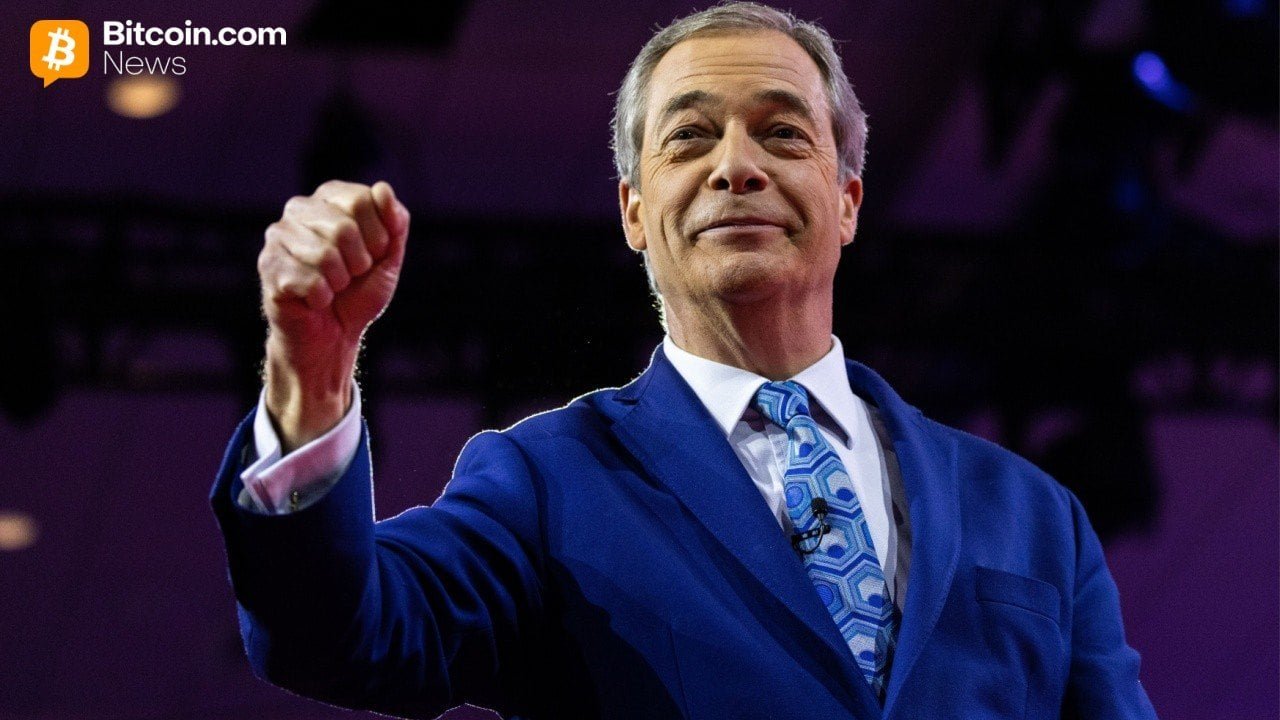

Nigel Farage Discloses $288,000 Stake in Former UK Chancellor’s Bitcoin

Hong Kong Introduces Licensing for HKD-Linked Stablecoins

(Originally posted on : Crypto News – iGaming.org )

Hong Kong has introduced a formal licensing regime for stablecoin issuers, marking a new chapter in how the city governs crypto assets. On May 21, the Hong Kong Monetary Authority (HKMA) confirmed the Legislative Council passed the Stablecoins Bill, requiring all fiat-referenced stablecoin (FRS) issuers linked to the Hong Kong dollar to obtain a license—whether operating locally or abroad.

Good to know

- Only licensed issuers can offer or advertise stablecoins in Hong Kong.

- Issuers must maintain proper reserves and allow redemption at par.

- The law includes a six-month transition period with strict compliance rules.

Under the new law, any business offering FRS products must meet specific standards related to reserve management, client asset segregation, and stablecoin redemption at par value. Licensees must also comply with anti-money laundering measures, financial audits, risk disclosures, and governance requirements.

According to the HKMA, advertising stablecoins will only be permitted if issued by licensed entities—even during the law’s six-month transitional period.

The move is part of Hong Kong’s broader strategy to become a hub for digital asset innovation, while keeping financial risks under control. HKMA Chief Executive Eddie Yue said, “The Ordinance has established a risk-based, pragmatic, and flexible regulatory regime. We believe that a robust and fit-for-purpose regulatory environment would provide favourable conditions to support the healthy, responsible, and sustainable development of Hong Kong’s stablecoin and the broader digital asset ecosystem.”

New players only. Exclusive 111% Welcome Bonus + 111 Free Spins

Only approved institutions will be able to offer FRS products to retail users. The government plans further consultation rounds to fine-tune the details of the new regulatory structure. Future initiatives may include oversight for virtual asset over-the-counter (OTC) trading and custody services.

Christopher Hui, Secretary for Financial Services and the Treasury, reinforced the government’s position on applying consistent oversight, noting that the framework follows the “same activity, same risks, same regulation” principle. He added that the Stablecoins Bill creates a strong foundation for the continued development of the virtual asset industry in Hong Kong.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Figure Heloc

Figure Heloc  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Sui

Sui  Zcash

Zcash  WETH

WETH  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  Pi Network

Pi Network  OKB

OKB  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Sky

Sky  Aster

Aster  Falcon USD

Falcon USD  Global Dollar

Global Dollar  Aave

Aave  syrupUSDC

syrupUSDC  NEAR Protocol

NEAR Protocol  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Worldcoin

Worldcoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  Quant

Quant  Midnight

Midnight  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  NEXO

NEXO  Jito Staked SOL

Jito Staked SOL  Cosmos Hub

Cosmos Hub  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  OUSG

OUSG  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Wrapped BNB

Wrapped BNB  Algorand

Algorand