Prediction Markets Light up After Supreme Court Blocks Trump Tariffs

How Web3 will Shape the Future of Finance?

(Originally posted on : NFTICALLY )

As its decentralized data storage capabilities improve, Web3 becomes more remarkable. Users may now use blockchain and connected data to create a new generation of dedicated apps, allowing users to control who can access their personal information and where they can share it.

Through decentralized technology, there will be a rush of new computer advancements and new economic sectors.

We are analyzing Web3 and Blockchain financial trends to determine which industries will grow the most in the next 5–10 years. Web3 includes IoT and decentralized apps.

Blockchain, a peer-to-peer distributed ledger, stores cryptographically timestamped transactions in an immutable public database.

Emerging Trends and Macroeconomic Forces

Primarily, the decentralization of money will be a significant development in Web3.

People are increasingly shifting away from banks, causing a significant shift in the financial environment.

In the digital money revolution, digital wallets such as Coinbase, Circle, and Xapo are leading the way. They make it easier to keep and transfer funds. Having greater control over their digital assets or the capacity to sign smart contracts gives them more freedom. A single wallet service, like Trust Wallet, has over $25 million customers.

In 2021, a total of $6.6 billion was invested in Blockchain technology, and by 2024, this amount is projected to increase to $19 billion.

In its most recent funding round, Andreessen Horowitz, an asset management company, garnered $4.5 billion from private investors. However, dApps (decentralized applications) and the blockchain’s backbone will be supported using the cash received.

The worldwide adoption rate of cryptocurrency has risen beyond the 4.0 percent threshold. According to Triple-A.

Cryptocurrencies

In May 2022, stablecoins were one of the most talked-about topics. Bitcoin is the most well-known cryptocurrency, but stablecoins are the most popular.

For example, a “pegged” currency like stablecoin relates to another money or asset.

Consequently, users can deal using digital representations of goods and currencies while maintaining price stability. Tether, USD Coin, and Binance USD have a combined value of almost $150 billion.

Algorithmic stable coins

“Algo-coins” employ mathematical procedures to maintain the proper coin-to-asset ratio.

However, TerraUSD’s decline was the second greatest algorithmic stablecoin crash in the previous year after TITAN coin’s -95% one-month loss in 2021. These two instances eroded investors’ faith in algorithmic stablecoins.

Future Advancement

In conclusion, companies in Web3 will focus on making the blockchain network more user-friendly. Bitcoin’s Lightning Network and Ethereum 2.0 are two examples of enhancing the user experience so that when more people join crypto, they do not face concerns like high transaction fees for little payments.

After that, the 2021 crypto craze brought in a lot of newbies. Over 10 million new crypto wallets have been established in the last two years, and ICOs have raised $27 billion. Many developers and producers have jumped ship and joined the crypto revolution, benefiting the industry.

However, in the next two to three years, we expect to see the creation of dApps, hardware wallets, and other essential protocols that will repeat the cycle.

Banking or Finance

In 2021, decentralized banking grew by 1500%, and in 2022, it used cryptocurrencies to secure transactions worth more than $14T.

Another recent study shows that banks and insurance companies are using artificial intelligence to automate credit risk modeling and update how credit scores are calculated. This proves that AI is essential for managing assets in the digital age.

DeFi

Decentralized finance, or “DeFi,” refers to peer-to-peer (P2P) technology and encryption as an alternative to traditional financial institutions for transmitting and receiving money.

Open-source platforms and technology may help lower the cost of financial services.

DeFi initiatives like digital wallets, staking projects, and smart oracles, according to a Future Today Institute study, have the potential to develop significantly.

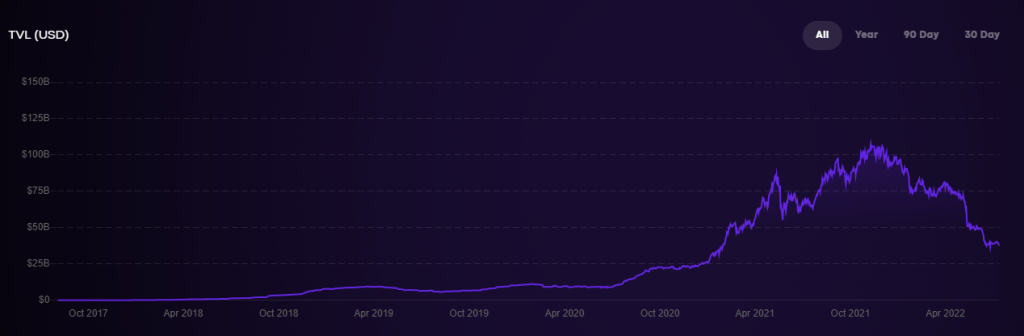

DeFi technology’s growth between October 2017 and May 2022 is seen in this graph. After mid-2021, things are going to become a lot better!

Conclusion

If you are looking for a method to get a head start on Web3 and DeFi, look no further than this: Considering recent predictions that the widespread acceptance of cryptocurrency will rise to 10% by 2030, having a system in place that can manage the influx of millions of inexperienced users is critical.

The initiatives that are most likely to gain traction in the next two to five years and serve as the foundation for the next wave of crypto and Web3 growth are digital wallets, upgrades to current Blockchains, and the creation of new dApps and DeFi protocols.

NFTICALLY’s blogs provide in-depth instructions on various related topics. Above all, visit our FAQs or join our Discord or Telegram channels for 24/7 help with any NFT-related inquiries.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Monero

Monero  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Hedera

Hedera  sUSDS

sUSDS  Zcash

Zcash  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Sui

Sui  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  PAX Gold

PAX Gold  MemeCore

MemeCore  Uniswap

Uniswap  Polkadot

Polkadot  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Aster

Aster  Pepe

Pepe  Bittensor

Bittensor  Falcon USD

Falcon USD  OKB

OKB  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Circle USYC

Circle USYC  Pi Network

Pi Network  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Sky

Sky  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Internet Computer

Internet Computer  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  NEXO

NEXO  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  USDtb

USDtb  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Render

Render  USDD

USDD  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC