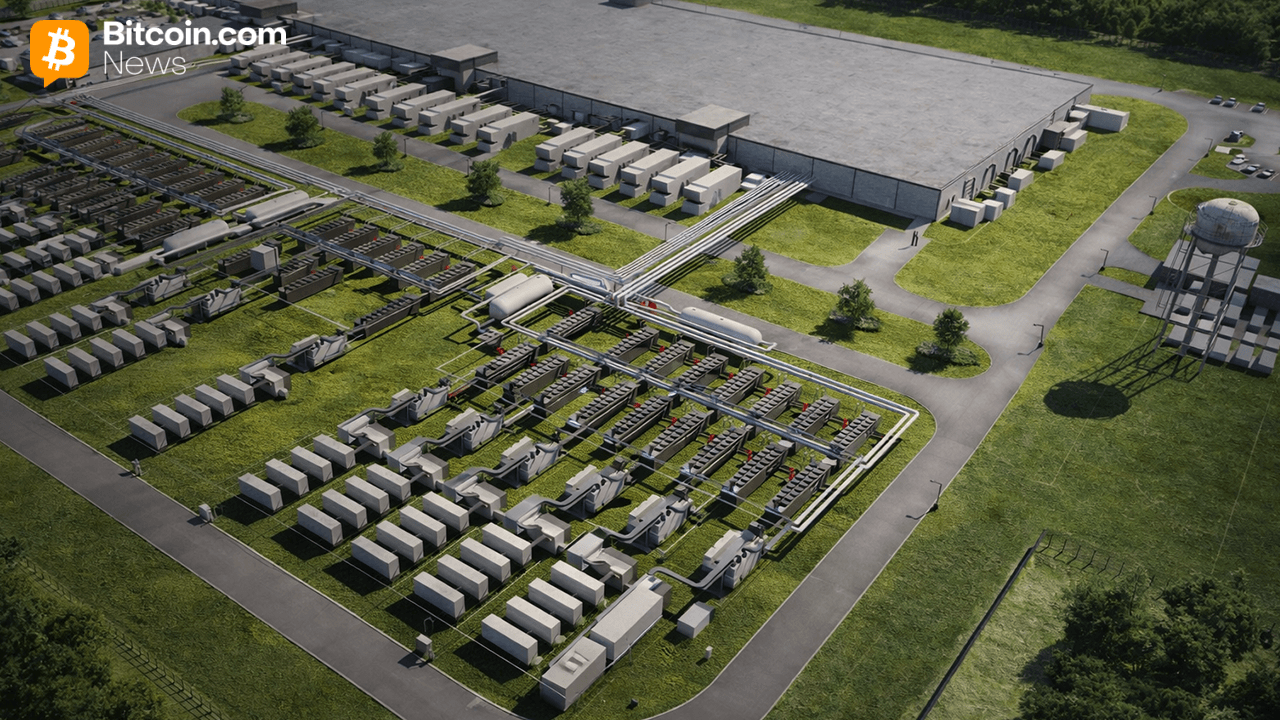

Morgan Stanley Backs Core Scientific With up to $1B Financing

JPMorgan Warns of Tough Times Ahead for US Stocks

(Originally posted on : Crypto News – iGaming.org )

As we enter the new year, JPMorgan, America’s largest bank, is alerting investors to significant market challenges. Marko Kolanovic, JPMorgan’s chief market strategist, forecasts a tough period for US equities, emphasizing the likelihood of a recession and slowed growth.

Kolanovic presents a complex situation for the US markets, expressing concern over the Federal Reserve’s response to market downturns. He elaborates, “This is a catch-22 situation… This would imply that we would need to first see some market declines and volatility during 2024 before easing of monetary conditions and a more sustainable rally.” This perspective indicates that a decline in the market might be a precursor to any improvement in monetary policies.

Yahoo Finance anchor Seana Smith discusses Kolanovic’s predictions in her report. He has often taken a bearish stance, foreseeing minimal growth in equities for the upcoming year. Kolanovic warns, “In his expected environment of declining growth or a recession, he’s saying that this group could actually underperform cash by around 20%.” This suggests a greater risk for the markets ahead.

Smith also highlights the critical role of the Federal Reserve in this scenario. The market’s anticipation of rate cuts could be overly optimistic. She notes, “A lot of this, a lot of these projections hinging around what the Fed rate cut timeline looks like exactly when we could potentially see a rate cut.” This underscores the uncertainty surrounding the Fed’s decision-making process and its impact on the market.

The Federal Reserve’s actions, particularly concerning interest rate cuts, will be closely monitored, as they play a key role in shaping market expectations and outcomes.

New players only. Exclusive 111% Welcome Bonus + 111 Free Spins

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Figure Heloc

Figure Heloc  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Monero

Monero  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Hedera

Hedera  sUSDS

sUSDS  Litecoin

Litecoin  Dai

Dai  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Zcash

Zcash  Sui

Sui  WETH

WETH  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Pi Network

Pi Network  Aster

Aster  Bittensor

Bittensor  Sky

Sky  Aave

Aave  Falcon USD

Falcon USD  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  NEAR Protocol

NEAR Protocol  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Ondo US Dollar Yield

Ondo US Dollar Yield  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Filecoin

Filecoin  Wrapped BNB

Wrapped BNB  Official Trump

Official Trump  Function FBTC

Function FBTC