Mark Karpelès Proposes Bitcoin Hard Fork to Recover 79,956 BTC

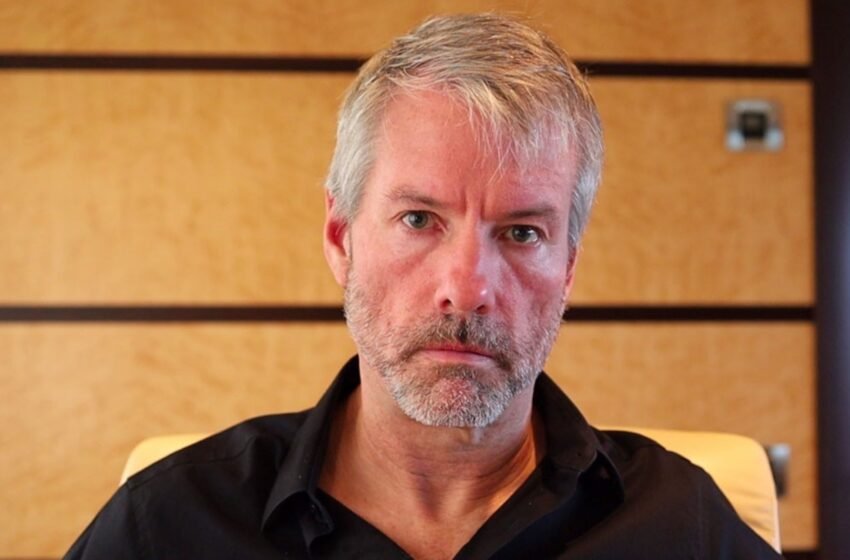

Michael Saylor Envisions Bitcoin as a “Legitimate Treasury Reserve Asset” for US Companies

(Originally posted on : Crypto News – iGaming.org )

Michael Saylor, the founder and executive chairman of MicroStrategy, recently shared his opinion with CNBC that big US corporations may soon begin to use Bitcoin (BTC) as a “legitimate” treasury reserve asset. Saylor emphasized the possible impact of bitcoin and new Financial Accounting Standards Board (FASB) regulations on the disclosure of cryptocurrency holdings by businesses.

Saylor stressed the importance of the FASB guidelines that would be implemented after December 15, 2024. As per the regulations, organizations that are publicly listed and possess cryptocurrencies must disclose the “fair value” of these assets on their balance sheets. Saylor proposed that the adoption of this modification in fair value accounting would make Bitcoin a suitable treasury reserve asset for corporations such as Apple Computer and Berkshire Hathaway.

Fair Value Accounting and Bitcoin’s Role

The adoption of fair value accounting for Bitcoin might provide an alternative for businesses who are presently forced to invest extra cash in sovereign debt and treasuries. The FASB wants to rectify the inadequacies of the current regulations, which only oblige businesses to report on losses on their cryptocurrency holdings—not gains. It is anticipated that the switch to fair value assessment would more accurately capture the financial elements of cryptocurrency assets.

Saylor positioned Bitcoin inside the larger digital trend. He highlighted the part that Bitcoin plays in the continuous digital transformation of capital, drawing comparisons with the digital revolutions spearheaded by firms such as Apple and Google. Saylor observed that when individuals gain more knowledge about digital assets, they are beginning to see how important it is to invest more money in them.

Saylor emphasized the basic question of whether Bitcoin is considered a genuine institutional asset, even if he acknowledged the possibility that the cryptocurrency’s value may rise to unprecedented heights. He said that institutions are starting to realize how important it is to devote more cash to this digital asset as a result of the continuous digital revolution and growing awareness.

New players only. Exclusive 111% Welcome Bonus + 111 Free Spins

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Figure Heloc

Figure Heloc  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Canton

Canton  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Hedera

Hedera  sUSDS

sUSDS  PayPal USD

PayPal USD  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Zcash

Zcash  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Cronos

Cronos  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  PAX Gold

PAX Gold  MemeCore

MemeCore  Uniswap

Uniswap  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Aster

Aster  Global Dollar

Global Dollar  Bittensor

Bittensor  Falcon USD

Falcon USD  Aave

Aave  OKB

OKB  Pi Network

Pi Network  Sky

Sky  Pepe

Pepe  syrupUSDC

syrupUSDC  Bitget Token

Bitget Token  NEAR Protocol

NEAR Protocol  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  BFUSD

BFUSD  Ondo

Ondo  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Pump.fun

Pump.fun  Gate

Gate  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Quant

Quant  Cosmos Hub

Cosmos Hub  NEXO

NEXO  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Filecoin

Filecoin  OUSG

OUSG  Wrapped BNB

Wrapped BNB  Aptos

Aptos