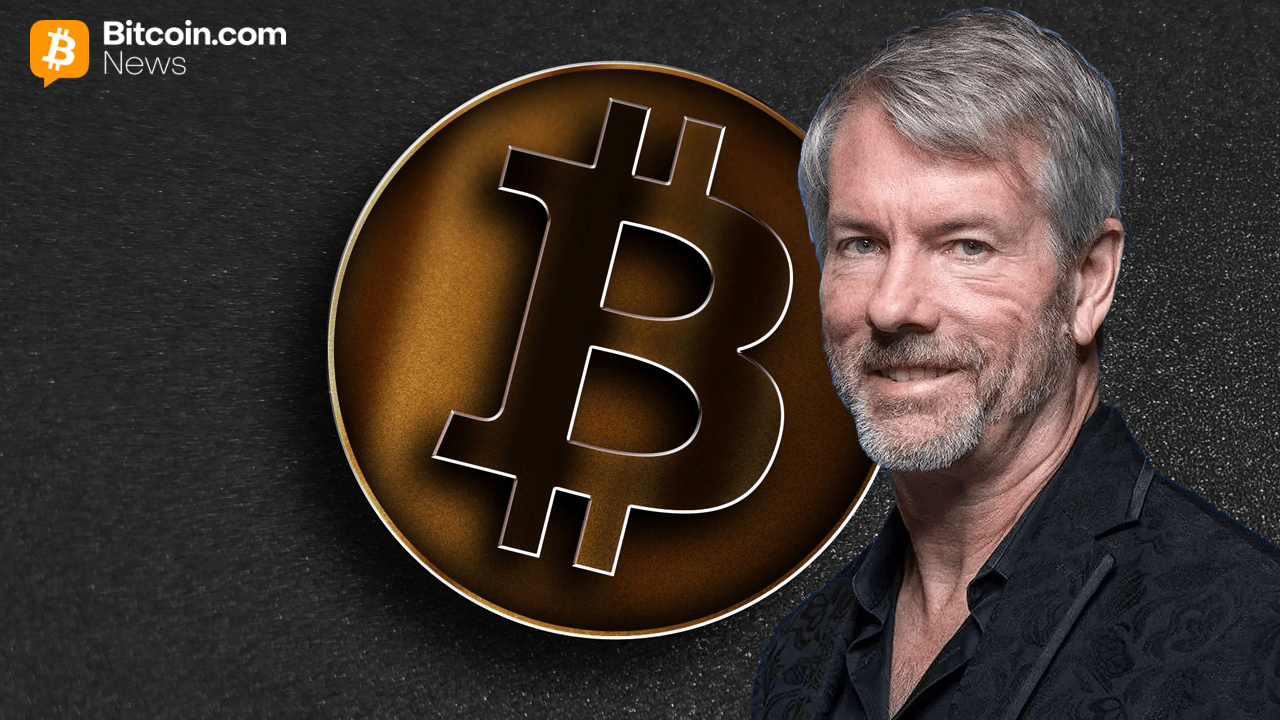

Strategy Founder Michael Saylor Fires Back at Bitcoin Critics in

MicroStrategy Joins Nasdaq-100 Index on December 23

(Originally posted on : Crypto News – iGaming.org )

MicroStrategy, the largest corporate holder of Bitcoin, will officially join the Nasdaq-100 index on December 23, thereby cementing the company’s place among some of the most influential firms on the stock exchange, including tech giants like Apple, Microsoft, Amazon, and Alphabet.

The Nasdaq-100 index comprises the top 100 non-financial companies listed on the Nasdaq by market capitalization. MicroStrategy’s inclusion reflects its strong stock performance and its pivot from a software company to a Bitcoin-focused treasury strategy. Over the past year, the company’s stock value has risen over sixfold, aligning with the Nasdaq-100 index’s 30% gain in 2024.

Joining this elite group often boosts a company’s stock visibility. Funds and ETFs that track the Nasdaq-100 will now adjust their holdings to include MicroStrategy, potentially increasing demand for its stock. However, staying in the index requires the company to maintain strong market performance, as underperforming firms like Illumina, Super Micro Computer, and Moderna learned this year when they were removed.

MicroStrategy began acquiring Bitcoin in 2020 to counter declining software revenue and adopt it as a treasury reserve asset. The strategy has paid off, with the company’s market cap now nearing $97.94 billion. Executive Chairman Michael Saylor has been a key figure in this transformation, advocating for Bitcoin as a store of value.

Recently, MicroStrategy added 21,550 Bitcoin to its holdings, purchasing them for $2.1 billion between December 2 and December 8. This brings its total Bitcoin holdings to 423,650 BTC, reinforcing its position as the largest corporate Bitcoin holder.

New players only. Exclusive Welcome Bonus of up to $2,500

MicroStrategy isn’t the only new addition to the Nasdaq-100 this year. Palantir Technologies and Axon Enterprise also joined the index, which continues to be a benchmark for high-performing tech and innovation-driven companies.

Being part of the Nasdaq-100 enhances MicroStrategy’s reputation and opens doors for greater institutional investment. While this milestone validates the company’s strategy, it also brings new expectations. Maintaining its position will require continued strong performance in both its stock and its Bitcoin strategy.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Figure Heloc

Figure Heloc  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Canton

Canton  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Dai

Dai  sUSDS

sUSDS  PayPal USD

PayPal USD  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Sui

Sui  Toncoin

Toncoin  Cronos

Cronos  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Falcon USD

Falcon USD  Aave

Aave  Aster

Aster  Global Dollar

Global Dollar  Pepe

Pepe  Bittensor

Bittensor  Circle USYC

Circle USYC  Ripple USD

Ripple USD  OKB

OKB  Bitget Token

Bitget Token  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Pi Network

Pi Network  Sky

Sky  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  Internet Computer

Internet Computer  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Worldcoin

Worldcoin  Pump.fun

Pump.fun  Cosmos Hub

Cosmos Hub  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Quant

Quant  USDtb

USDtb  NEXO

NEXO  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  USDD

USDD  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  pippin

pippin  OUSG

OUSG  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund