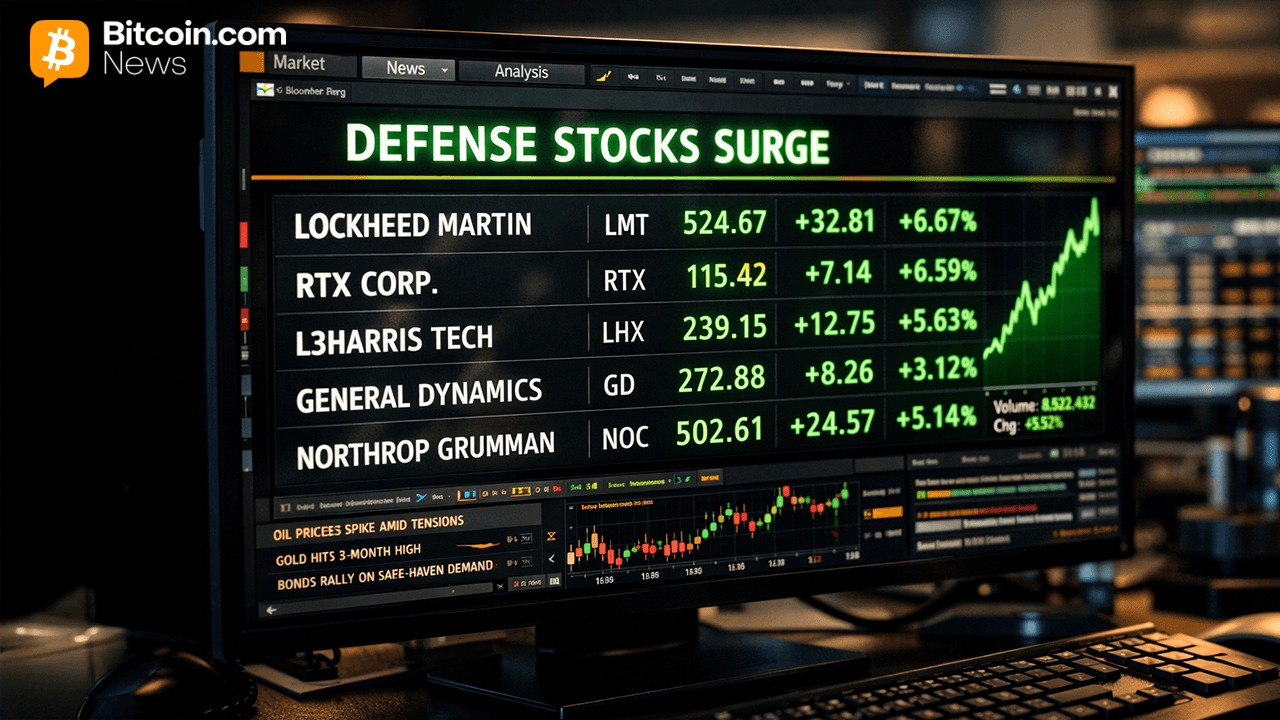

Wall Street Dumps Tech, Rotates Hard into War Economy Names;

The FSB’s Call for Enhanced Regulations in Crypto

(Originally posted on : Crypto News – iGaming.org )

The Financial Stability Board (FSB) has recommended stricter rules in response to growing worries about the behavior in the cryptocurrency industry. The FSB, which is made up financial regulators from different nations throughout the world, seeks to create thorough and consistent rules for the sector. The decision was made in response to various high-profile events, including accusations made against FTX and Celsius. The FSB wants to address the structural weaknesses and inherent volatility of crypto-assets and the related entities by suggesting stronger regulations.

Cracking Down on Misconduct

Recent FTX and Celsius controversies have made it clear that more monitoring and investigation are required. Allegations of improper record-keeping and the misappropriation of client monies forced FTX to file for bankruptcy. Alex Mashinsky, a co-founder of Celsius, is accused of deceiving investors and manipulating token pricing for his own advantage, among other things. The FSB has acted to promote stricter restrictions as a result of these instances.

New players only. Welcome Bonus – 125% bonus on your first deposit up to $2,500

Different countries have chosen various strategies for regulating cryptocurrencies. The Markets in Crypto Assets (MiCA) law was developed by the European Union with this sector in mind. In contrast, the Securities and Exchange Commission (SEC) of the United States is looking at how current financial instrument regulations may be applied to the cryptocurrency industry. The FSB’s suggestions are designed to find a balance between accommodating various methods, preserving uniformity, and guaranteeing the sector’s integrity.

Flexibility and Continuity

The worldwide framework does not entirely rewrite the rules for crypto-assets, FSB Secretary General John Schindler underlined when making these ideas. He emphasized the similarities between operations involving crypto assets and conventional financial activity, arguing that the same regulations had to be in place. While governments seek to put these expectations and norms into place, the FSB advises participants in the crypto asset market to start immediately following them.

Industry participants have reacted differently to the FSB’s proposals. Traditional financial institutions have argued in favor of tighter regulations, underlining the need for more industry supervision. However, significant cryptocurrency exchanges like Binance and Coinbase have voiced worries that more stringent rules may stifle innovation. Regulators continue to face significant difficulties in striking a balance between providing effective monitoring and promoting innovation.

New players only. Welcome Bonus – 125% bonus on your first deposit up to $2,500

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Monero

Monero  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Ethena USDe

Ethena USDe  Stellar

Stellar  USD1

USD1  Wrapped eETH

Wrapped eETH  Rain

Rain  Hedera

Hedera  sUSDS

sUSDS  Dai

Dai  PayPal USD

PayPal USD  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Zcash

Zcash  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Cronos

Cronos  Toncoin

Toncoin  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Aave

Aave  Global Dollar

Global Dollar  Bittensor

Bittensor  Aster

Aster  Falcon USD

Falcon USD  NEAR Protocol

NEAR Protocol  Sky

Sky  OKB

OKB  syrupUSDC

syrupUSDC  Pi Network

Pi Network  Bitget Token

Bitget Token  Pepe

Pepe  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Ethena

Ethena  Ondo US Dollar Yield

Ondo US Dollar Yield  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Quant

Quant  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  OUSG

OUSG  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin